Editor's Note

It’s Monday, a new week, a new slate, and another opportunity to lead with clarity.

CEOs In The News is a weekly intelligence briefing for senior leaders, boards, and those shaping the future of business. Each edition curates the most important executive moves, corporate shifts, and leadership trends — with clear insights on why they matter.

Our mission is simple: deliver clarity, signal, and strategic perspective in minutes — so you start the week one step ahead of the boardroom narrative.

Executive Moves of the Week

Executive musical chairs continued at a brisk pace this week, with significant appointments across the technology, financial services, and consumer sectors. Of note is the continued trend of installing seasoned executives from outside the organization to helm major turnarounds or strategic pivots, as seen at Verizon and Walgreens.

Company | Incoming/Outgoing Executive | Role | Context |

Microsoft | Judson Althoff | CEO, Commercial Business | Internal promotion; allows Satya Nadella to focus on technology and AI. |

Verizon | Dan Schulman (in) / Hans Vestberg (out) | CEO | Former PayPal CEO brought in to lead a strategic shift. |

Oracle | Clay Magouyrk & Mike Sicilia (in) / Safra Catz (out) | Co-CEOs | Catz moves to Vice Chair, adopting a co-CEO model for the next phase of growth. |

T-Mobile | Srinivasan Gopalan (in) / Mike Sievert (out) | CEO | Internal promotion as Sievert retires. |

Walgreens | Mike Motz | CEO | Retail veteran appointed after the company was taken private by Sycamore. |

Porsche AG | Oliver Blume | CEO | Stepping down to focus on his primary role as head of Volkswagen Group. |

Bridgestone | Yasuhiro Morita (in) / Shuichi Ishibashi (out) | Global CEO | Internal promotion following resignation of predecessor. |

JPMorgan Chase | Conor Hillery & Matthieu Wiltz | Co-CEOs, EMEA | New co-CEO structure for the European, Middle East, and Africa business. |

Fiserv | Paul Todd (in) / Bob Hau (out) | CFO | Former Global Payments CFO brought in to replace retiring finance chief. |

PepsiCo | Steve Schmitt | EVP & CFO | Schmitt joins from Walmart, where he was CFO for the U.S. business. |

Stellantis | Joao Laranjo | CFO | Appointment comes as the automaker navigates a difficult U.S. market. |

Nestlé | Philipp Navratil (in) / Laurent Freixe (out) | CEO | Freixe was terminated over a concealed relationship with a subordinate. |

Sector Turnover: Where the Pressure is Highest

Data from 2024 shows that the Consumer and Industrial sectors are experiencing the highest rates of CEO turnover, both at 12%. This reflects heightened external pressure on boards to intervene when performance wanes. In contrast, the Financial Services and Technology sectors, which have performed well, saw the lowest turnover rates at 7% [1].

Corporate & Market Shifts

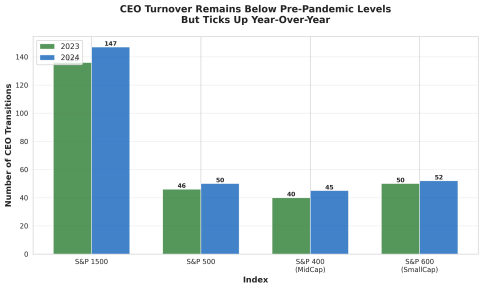

The slight but steady increase in CEO transitions across all market caps signals a broader market adjustment. While still below pre-pandemic levels, the year-over-year uptick suggests boards are becoming less patient and more willing to make leadership changes to navigate economic uncertainty and technological disruption.

Two major themes are driving these shifts:

Private Equity Influence: The appointment of retail veteran Mike Motz as CEO of Walgreens following its acquisition by Sycamore Partners is a classic example of private equity installing new leadership to drive aggressive operational and financial improvements. Expect more PE-driven leadership changes as firms look to unlock value in their portfolio companies.

Corporate Restructuring: Keurig Dr Pepper’s decision to split into two publicly traded companies—one for coffee and one for beverages—creates two new CEO roles. This type of strategic de-conglomeration is often a precursor to leadership specialization, as each new entity requires a focused chief executive to navigate its specific market challenges.

The CEO Lens: The Outsider Advantage and the Shrinking Timeline

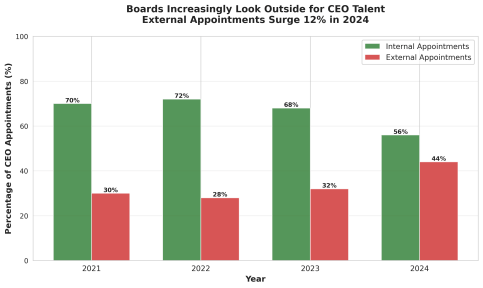

A decade ago, the path to the corner office was a marathon run within a single corporate culture. Today, it is increasingly a sprint won by outsiders. Data from

Spencer Stuart reveals a significant trend: 44% of new CEOs appointed in 2024 came from outside the company, a 12% jump from the previous year [2]. This acceleration in external hiring is coupled with another stark reality: the average CEO tenure has fallen to just 6.8 years in the first half of 2025, a 13% decline since 2020 [3].

Why the shift? Boards are prioritizing proven experience in the face of disruption. When a company needs a rapid turnaround or a fundamental strategic pivot, an external candidate often brings a fresh perspective, a sense of urgency, and skills the organization currently lacks. This playbook was famously executed by Louis Gerstner at IBM in 1993. Hired from RJR Nabisco, Gerstner was an industry outsider who dismantled IBM’s insular culture and saved the company from collapse by focusing on integrated solutions rather than just hardware [4]. His success became a template for the transformative power of an external leader.

However, the pressure for immediate results has also shortened the CEO lifecycle. The days of a decade-plus reign, like that of Jack Welch at General Electric, are fading. Welch’s own handpicked successor, Jeff Immelt, struggled to replicate his performance, and the company’s value subsequently eroded, leading to its eventual breakup. This serves as a powerful cautionary tale: even a legendary CEO can fail at the crucial task of succession, and a long tenure is no guarantee of a lasting legacy [5].

For boards, the lesson is clear: the selection of a CEO is not just about finding a capable operator, but about matching the right leadership profile to the company’s strategic moment. The increasing reliance on outsiders reflects a market that values adaptability and proven turnaround skills over institutional knowledge alone.

Leadership Insights

For Boards: Treat Succession as a Perpetual Campaign. The shrinking CEO tenure means succession planning can no longer be a periodic event. It must be a continuous process of identifying and nurturing internal talent while simultaneously mapping the external market. As the IBM and GE cases show, a smooth transition is a critical component of long-term value creation. Boards should have a ready-to-activate emergency succession plan at all times.

For CEOs: Build Your Legacy Through Your Successor. Your ultimate performance review is the success of the person who follows you. The modern CEO role involves not just leading the company, but preparing it to thrive after your departure. This requires a selfless commitment to mentorship, a willingness to expose potential successors to the board, and an objective assessment of the skills needed for the next decade, not just the next quarter.

CEOs Who Got It Wrong

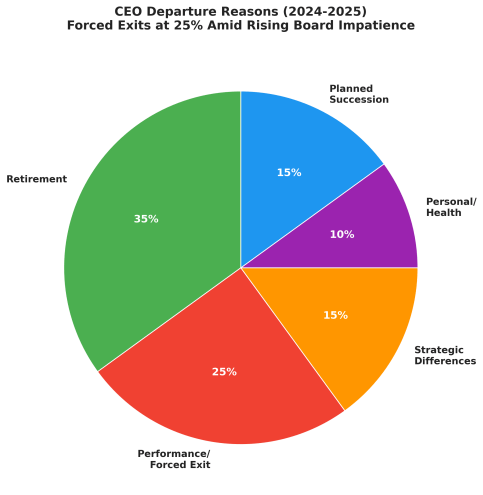

Not all leadership transitions are strategic. This year has been marked by a significant number of forced exits, with an estimated 25% of CEO departures in 2024-2025 being involuntary. These are often the result of governance failures, ethical lapses, or a simple inability to perform.

AI. Case Study: Nestlé and the Cost of Concealment

The most dramatic recent example is the termination of Nestlé CEO Laurent Freixe in September 2025. Appointed less than a year prior, Freixe was fired for concealing a romantic relationship with a subordinate, a clear violation of the company’s code of conduct [6]. The board’s swift and decisive action underscores a new era of accountability. In a world of radical transparency, ethical breaches are no longer private matters; they are significant business risks that can trigger immediate and severe consequences. The fallout was immediate, with new CEO Philipp Navratil announcing 16,000 job cuts just weeks later to ignite a “turnaround fire” [7].

Case Study: Boeing’s Crisis of Confidence

The departure of Boeing CEO Dave Calhoun, planned for the end of 2024, is the culmination of a multi-year crisis of confidence in the company’s safety culture and manufacturing quality. The 737 MAX disasters and subsequent operational failures created a situation where a leadership change became inevitable to restore trust with regulators, customers, and the public [8]. This was not a failure of a single quarter’s earnings, but a deep, systemic failure of leadership to uphold the company’s core promise of safety. The ongoing management shakeup, which began before Calhoun’s official departure, demonstrates the long road Boeing faces in rebuilding its reputation.

Jobs on the Move

Several high-profile CEO and executive positions are currently open, reflecting the active state of the leadership market. These searches represent opportunities for significant strategic shifts at these organizations.

Boeing: The search for a successor to Dave Calhoun is one of the most closely watched in the world. The next CEO will face the monumental task of fixing the company’s culture and operations.

5N Plus Inc.: The specialty materials company has initiated a search for a new CFO following the announcement of a CEO succession plan.

National Association of Diversity Officers in Higher Education: Seeking a new President and CEO in Washington, D.C.

Health District of Northern Larimer County: Open search for an Executive Director / Chief Executive Officer, with first resume reviews starting November 7, 2025.

The Watchlist

Succession Rumors: All eyes are on Disney as CEO Bob Iger’s contract extension comes to an end in 2026. The board is under immense pressure to ensure a smooth and successful transition this time around, after the failed succession of Bob Chapek. Potential internal candidates are being closely watched.

Tenure Data: The average CEO tenure continues to shrink, putting pressure on boards to have a perpetual list of potential successors. The industrial and consumer sectors, with their high turnover rates, are particularly vulnerable to succession crises.

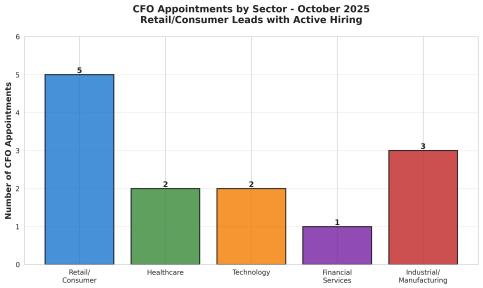

Rising Leaders: Keep an eye on the cohort of recently appointed CFOs, especially those in the active retail and consumer sectors. The CFO role is increasingly seen as a direct stepping stone to the CEO position. Individuals like Steve Schmitt at PepsiCo and Todd Cunfer at Campbell’s are now in prime positions to prove their operational and strategic leadership capabilities.Rising Leaders and Succession Candidates

Closing Word

The velocity of leadership change is accelerating. The mandate for boards and CEOs is no longer just about performance, but about preparedness. The companies that will win the next decade are those that treat leadership succession not as a crisis to be managed, but as a strategic advantage to be cultivated.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded t you? Sign up here.