Editor's Note

Thursday is where the week’s real story comes into focus.

While Monday sets the tone, Thursday reveals the underlying trends — the leadership decisions, market movements, and strategic shifts that signal where industries are heading next. This edition distills those developments into clear, actionable insight for senior leaders, board members, and anyone responsible for shaping strategy in a volatile environment.

Our purpose is simple: deliver clarity, signal, and forward-looking perspective — so you can finish the week with sharper judgment and stronger strategic footing.

A Week of Resurgent Dealmaking and AI-Fueled Growth

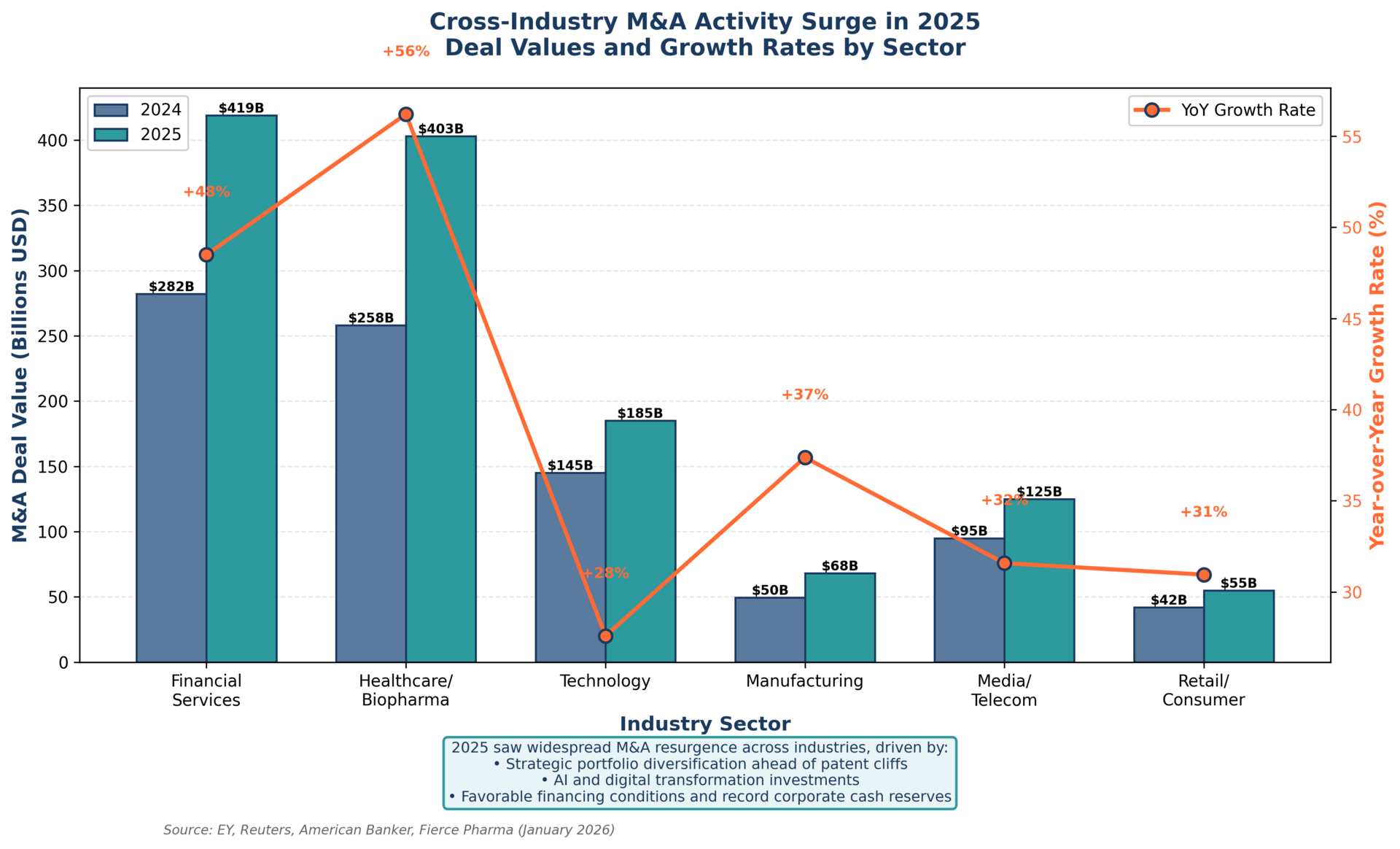

The second week of 2026 has been characterized by a potent mix of resurgent M&A activity, record-breaking financial performance, and an accelerating technological arms race centered on artificial intelligence. Across the eight major industries tracked in this newsletter, a clear theme emerges: businesses are moving from a stance of cautious optimism to proactive strategic maneuvering. This is most evident in the financial services and healthcare sectors, where deal values have soared, and in the technology sector, where the semiconductor industry continues its unprecedented AI-driven expansion. This edition of “Industry Recap & News” delves into the key developments, providing a PhD-level analysis of the forces shaping the corporate landscape.

Industry Activity Index

Global HR shouldn't require five tools per country

Your company going global shouldn’t mean endless headaches. Deel’s free guide shows you how to unify payroll, onboarding, and compliance across every country you operate in. No more juggling separate systems for the US, Europe, and APAC. No more Slack messages filling gaps. Just one consolidated approach that scales.

Finance, Banking & Insurance: A Banner Year Sets the Stage for 2026

The financial services sector has started the year with remarkable momentum, building on a banner year in 2025. The industry is characterized by a surge in M&A activity, with global financial services M&A value rising 49% year-over-year to $418.9 billion in 2025 [1]. This was driven by a 72% increase in megadeals (transactions over $1 billion), which accounted for 81% of the total deal value. While the total number of deals remained relatively flat, the significant increase in deal value points to a focus on high-quality, strategic acquisitions. As Omar Ali, EY Global Financial Services Leader, noted, “growth, scaling, and innovation are clearly at the top of the agenda” [1].

Wall Street banks are poised to report another year of record revenue and near-record profits for 2025, with all six major banks outperforming the S&P 500. The KBW Nasdaq Bank Index rose 29% in 2025, compared to the S&P 500’s 17% gain [2]. This strong performance is expected to continue into 2026, with some analysts predicting a third consecutive year of outperformance for the banking sector. However, a potential headwind has emerged in the form of a proposed 10% cap on credit card interest rates, which caused a sell-off in the stocks of major card lenders [2].

Technology: The Unstoppable Rise of AI and Semiconductors

The technology sector continues to be dominated by the transformative impact of artificial intelligence. The semiconductor industry, in particular, is experiencing unprecedented growth, with worldwide revenue growing 21% in 2025 to $793 billion [3]. AI semiconductors, including processors, high-bandwidth memory (HBM), and networking components, accounted for nearly one-third of total sales in 2025, with AI processing semiconductor revenue exceeding $200 billion. Gartner forecasts that AI infrastructure spending will surpass $1.3 trillion in 2026, and AI semiconductors are projected to represent over 50% of total semiconductor sales by 2029 [3].

NVIDIA has solidified its position as the market leader, becoming the first vendor to cross $100 billion in semiconductor sales and outpacing its closest competitor, Samsung, by $53 billion in revenue [3]. The company’s revenue grew by an astonishing 63.9% year-over-year. This growth is fueled by the insatiable demand for AI chips from major technology companies like OpenAI, Google, and Microsoft. The AI trend is also driving a surge in M&A activity within the tech sector, as companies look to acquire key technologies and talent.

Technology Sector Deep Dive

A big 2026 starts now. True builders use this stretch of time to get ahead, not slow down. Launch your website with AI, publish a stunning newsletter, and start earning more money quickly through the beehiiv Ad Network. Use code BIG30 for 30 percent off your first three months. Start building for 30% off today.

Healthcare: A Rebound in M&A and a Flurry of Innovation

The healthcare sector has seen a significant rebound in M&A activity, with deal volume rising 56% year-over-year to an estimated $403 billion in 2025 [4]. While the number of transactions fell by 8%, the increase in deal value indicates a trend towards fewer, but larger, strategic acquisitions. This resurgence is driven by looming patent expirations, a thawing biotech investment scene, and the availability of significant M&A firepower, with life sciences companies holding an estimated $2.1 trillion in available capital [5].

The top 10 biopharma M&A deals of 2025 highlight the industry’s focus on strategic acquisitions in areas like central nervous system diseases, neuromuscular diseases, and obesity. Johnson & Johnson’s $14.6 billion acquisition of Intra-Cellular Therapies for its antipsychotic drug Caplyta was the largest deal of the year [6]. The J.P. Morgan Healthcare Conference has also seen a flurry of announcements, with major pharmaceutical companies like Johnson & Johnson, Novartis, and Merck outlining ambitious growth targets and investment plans. The biotech sector is also experiencing a fundraising boom, with $2.5 billion raised from new share sales in the first week of January 2026, the biggest first week since 2021 [7].

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

Manufacturing: Navigating Uncertainty with AI and Automation

The manufacturing industry is at a crossroads, navigating a complex landscape of tariff uncertainty, evolving policy changes, and a push towards domestic production. While U.S. manufacturing output rose for the seventh successive month in December, new orders fell for the first time since December 2024, and manufacturing activity dropped to its lowest point of 2025 in December [8].

In response to these challenges, manufacturers are increasingly turning to AI and digital tools to enhance operational agility and competitiveness. A Deloitte survey found that the vast majority of manufacturers plan to invest 20% or more of their improvement budgets on smart manufacturing initiatives [9]. Agentic AI, which can autonomously reason and make decisions, is being leveraged to mitigate sourcing challenges and navigate trade risks. McKinsey projects that agentic AI could generate up to $650 billion in additional revenue by 2030 across industries [9]. The adoption of physical AI, such as robotic dogs and humanoids, is also on the rise, with 22% of manufacturers planning to use them by 2027.

Retail & Consumer Goods: A Strong Holiday Season Amidst Mixed Signals

The retail sector experienced a strong holiday season, with sales growing 4.1% year-over-year to just over $1 trillion, in line with the National Retail Federation’s forecast [10]. This growth was driven by strong consumer spending, with clothing and accessories, and sporting goods stores leading the way. Online shopping continued to grow, with 134.9 million shoppers, up 9% from 2024 [10].

However, the retail landscape is not without its challenges. While consumer spending remains solid, there are mixed earnings signals from retailers, with some, like Abercrombie & Fitch, tweaking their sales and earnings forecasts [11]. The rise of Gen Alpha is also reshaping the consumer landscape, with this demographic now driving about half of consumer spending in the US and UK, representing over $255 billion in spending across food, fashion, and leisure [12].

Industry Sentiment & Outlook

Energy & Utilities: Navigating the Transition to a Sustainable Future

The energy and utilities sector is in the midst of a profound transformation, driven by the global push towards sustainability and renewable energy. While analysts are optimistic about the renewable energy industry, expecting 24% annual earnings growth over the next 5 years, traditional oil and gas companies are facing significant regulatory pressures [13].

In New York, Governor Hochul has unveiled a ratepayer protection plan aimed at holding energy companies accountable for reducing energy bills and ensuring a reliable grid [14]. The transition to renewable energy is also a key focus, with the fixed wireless access (FWA) market expected to see significant growth, driven by 5G technology. Ericsson estimates that FWA lines will grow from 160 million at the end of 2024 to 350 million by 2030, with 80% of this growth attributed to 5G [15].

Media & Telecommunications: 5G, M&A, and the Future of Entertainment

The telecommunications industry has reached a five-year milestone in its 5G rollout, with the technology now demonstrating strong execution despite a “weak on vision” start [16]. T-Mobile has emerged as a leader in the U.S. wireless market, dominating both mobile network and fixed wireless access (FWA) broadband experience [17]. In the media and entertainment space, M&A activity is heating up, with a potential blockbuster deal between Netflix and Warner Bros. on the horizon [18]. The creator economy is also seeing a surge in M&A, with a 17.4% year-over-year increase in activity in 2025 [19].

Professional & Business Services: Cautious Optimism and a Focus on Innovation

Business leaders in the professional and business services sector are maintaining a cautious global outlook, with 73% holding a neutral or pessimistic view [20]. However, there is a strong focus on growth and innovation, with 73% expecting to increase revenue and 64% projecting higher profits in 2026. Product innovation is the top growth strategy, with 58% of leaders planning to introduce new products or services. M&A appetite is also on the rise, with 39% of respondents citing it as a potential growth strategy, up 8 percentage points from last year [20].

AI is a key focus for the sector, with most businesses planning to implement AI in 2026. The greatest focus is on process automation (62%), predictive analytics (44%), and market intelligence (42%). While 60% of midsize business leaders report that AI will have no impact on headcount, 24% of startups expect their AI adoption to lead to increased headcount [20].

Conclusion: A Year of Strategic Transformation

The early weeks of 2026 have set a clear tone for the year ahead: a period of strategic transformation driven by technological innovation and a renewed appetite for growth. The trends observed this week, from the M&A boom in financial services and healthcare to the AI-fueled expansion of the technology sector, will continue to shape the corporate landscape in the months to come. As businesses navigate this dynamic environment, the ability to adapt, innovate, and make bold, strategic moves will be more critical than ever.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded to you? Sign up here.