Editor's Note

Thursday is where the week’s real story comes into focus.

While Monday sets the tone, Thursday reveals the underlying trends — the leadership decisions, market movements, and strategic shifts that signal where industries are heading next. This edition distills those developments into clear, actionable insight for senior leaders, board members, and anyone responsible for shaping strategy in a volatile environment.

Our purpose is simple: deliver clarity, signal, and forward-looking perspective so you can finish the week with sharper judgment and stronger strategic footing.

Executive Moves of the Week

The C-suite carousel was in full spin this week, marked by significant transitions across the healthcare, technology, and industrial sectors. In a major move for the life sciences industry, Charles River Laboratories (CRL) announced that its long-serving CEO, James C. Foster, is retiring. The board has appointed current EVP and COO, Birgit Girshick, as the new CEO, signaling a focus on operational continuity and internal succession. Similarly, diagnostics firm Quanterix named Everett Cunningham as its new President and CEO, effective January 19, succeeding Masoud Toloue in a planned transition aimed at steering the company through its next growth phase. The industrial and construction sector also saw key changes, with Hensel Phelps promoting its COO, Brad Jeanneret, to the CEO role as Mike Choutka moves to become Chairman of the Board, a classic example of grooming an internal successor for the top job. In the financial technology space, Brazilian fintech giant StoneCo announced that Mateus Scherer will take the helm as CEO in March, a move intended to reinforce continuity and drive its next wave of innovation. The financial services sector continued this trend with FHLBank San Francisco appointing Winthrop Watson as its new Interim CEO, taking over from the retiring Joseph E. Amato. In a significant retail leadership change, Lululemon Athletica (LULU) announced that CEO Calvin McDonald will step down this month, a move that follows public criticism from the company’s founder and highlights the intense pressure on retail leaders. Finally, in a move that reverberated across the tech and retail landscape, Walmart (WMT) appointed Shishir Mehrotra, the CEO of Superhuman and former head of Grammarly, to its Board of Directors, signaling the retail giant’s deepening focus on technology and AI-driven productivity.

Corporate & Market Shifts

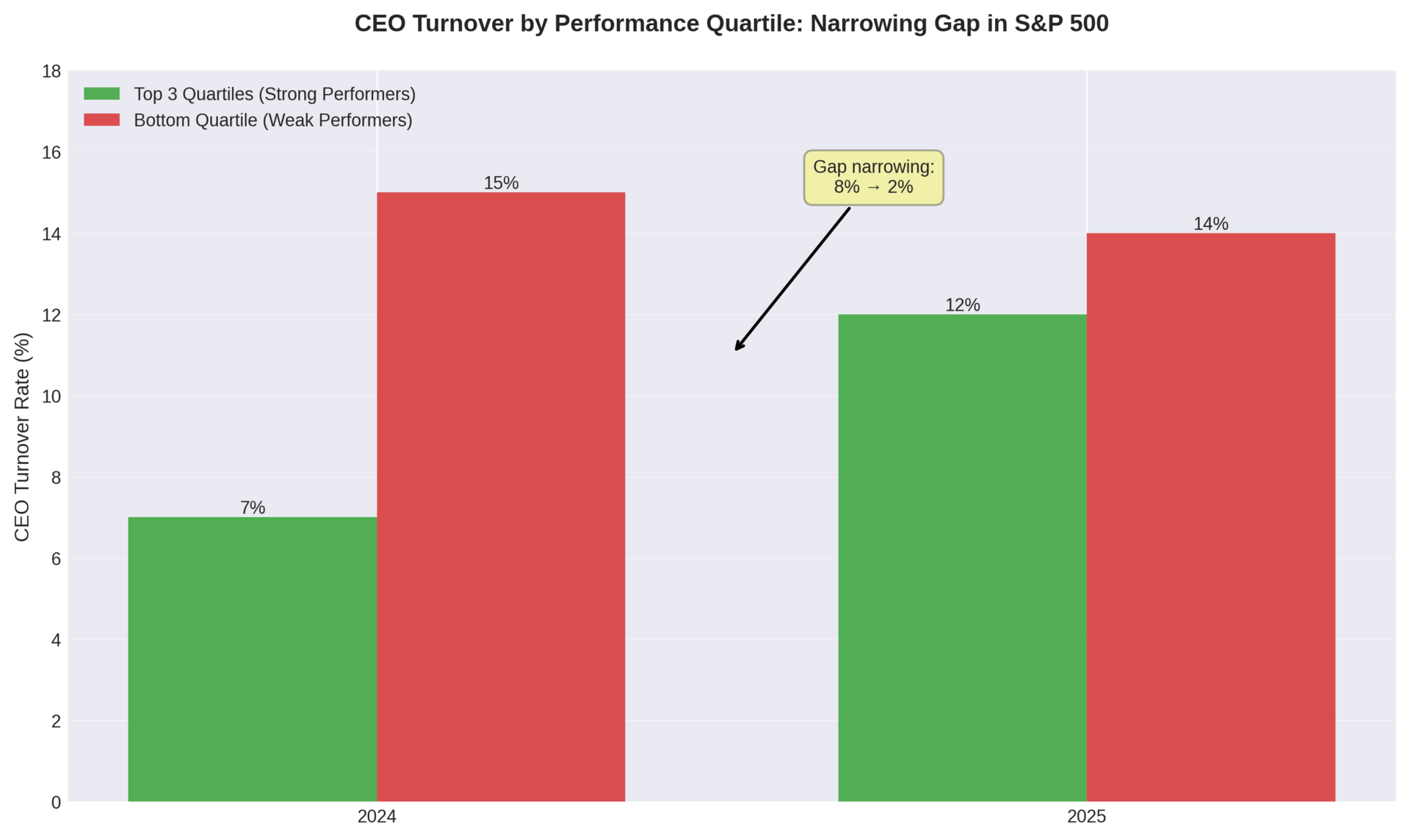

The overarching theme of 2025 has been a great recalibration in corporate leadership. After years of navigating pandemic-related disruptions, boards are now acting with greater confidence, advancing planned successions and making strategic leadership changes to position their companies for the future. Data from The Conference Board reveals that CEO turnover in the S&P 500 surged to a projected 13% in 2025, a significant jump from 10% in 2024 [8]. This acceleration is not merely a function of poor performance. In a striking departure from historical norms, the gap in turnover rates between the highest and lowest-performing companies is narrowing dramatically. CEO succession at top-quartile performers (by total shareholder return) jumped from 7% in 2024 to 12% in 2025, just shy of the 14% turnover rate seen at bottom-quartile firms [8]. This suggests that boards are increasingly proactive, making changes to align leadership with new strategic imperatives rather than simply reacting to poor results.

CEO Turnover by Performance Quartile

This proactive stance is further evidenced by a dramatic surge in the appointment of external CEOs. According to Spencer Stuart, 44% of all new S&P 1500 CEO appointments in 2024 were external hires, the highest level recorded since tracking began in 2000 [9]. This trend is particularly pronounced in the MidCap 400, where outsiders accounted for a remarkable 58% of new CEOs. Boards are clearly prioritizing fresh perspectives and transformative experience, seeking leaders who can navigate disruption and accelerate change, even if it means looking beyond the company’s own ranks.

Internal vs External CEO Appointments

The CEO Lens: The Outsider Advantage in an Age of Disruption

The pronounced shift toward external CEO candidates represents a pivotal moment in corporate governance. For decades, the conventional wisdom favored promoting from within, valuing deep institutional knowledge and cultural continuity. However, the current environment, characterized by rapid technological disruption, shifting stakeholder expectations, and intense market volatility, has upended this calculus. The data shows boards are increasingly willing to bet on outsiders to lead their companies through transformation. In 2025, external hires for S&P 500 CEO roles nearly doubled to 33% from 18% the previous year, the highest level in eight years.

This trend is not without historical precedent. The hiring of Lou Gerstner at IBM in 1993 is a classic case study. Facing near-bankruptcy, IBM’s board broke with tradition and brought in Gerstner, an outsider from RJR Nabisco, who famously declared, “the last thing IBM needs right now is a vision.” His relentless focus on customers, culture, and execution engineered one of the greatest turnarounds in corporate history. Conversely, the succession of Jeff Immelt at General Electric (GE), an insider who followed the legendary Jack Welch, serves as a cautionary tale. Despite his deep knowledge of the company, Immelt’s tenure was marked by strategic missteps and a failure to adapt to a changing world, ultimately leading to a massive decline in shareholder value. These cases highlight the critical trade-offs boards face. While insiders offer stability, outsiders can bring the objectivity and urgency needed to challenge the status quo and drive fundamental change. The current data suggests that in today’s turbulent landscape, a growing number of boards believe the potential rewards of an outsider’s perspective outweigh the risks.

Leadership Insights

This week’s analysis offers two critical takeaways for today’s leaders. First, performance is no longer a shield. The narrowing gap in turnover between high and low-performing CEOs indicates that delivering strong returns is not enough. Boards are adopting a more forward-looking, strategic approach to leadership evaluation. CEOs must not only deliver results today but also demonstrate a clear vision and capability to navigate the disruptions of tomorrow. This requires continuous self-assessment, a willingness to challenge one’s own assumptions, and a proactive engagement with the board on long-term strategy and succession.

Second, the path to the top is diversifying. While the COO role remains a primary launchpad to the CEO position, the rise of divisional CEOs (35% of first-time appointments) and the resurgence of CFOs (14%) underscore that boards are valuing a wider range of experiences [9]. Aspiring leaders should seek out P&L responsibility, whether in a divisional capacity or a key financial role, to build the well-rounded skill set that boards now demand. The era of a single, linear career path to the C-suite is over; a portfolio of diverse, high-impact experiences is the new currency of leadership succession.

CEOs Who Got It Wrong

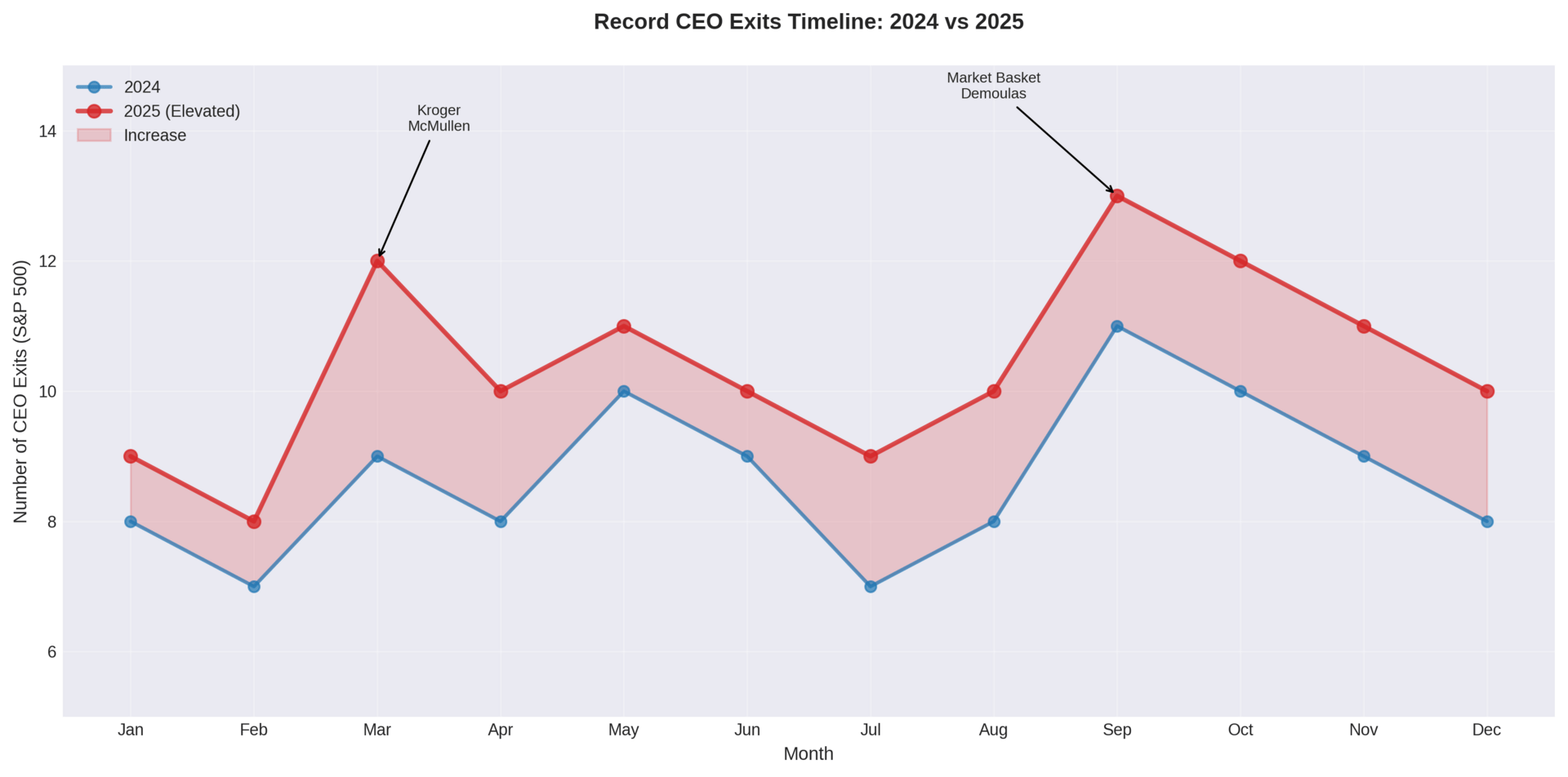

2025 was a tumultuous year for the C-suite, with several high-profile exits driven by governance failures and ethical lapses rather than just poor performance. The sudden resignation of Kroger (KR) CEO Rodney McMullen in March sent shockwaves through the industry. After 47 years with the company, his departure was attributed to a violation of the company’s business ethics policy related to personal conduct, a stark reminder that personal integrity is non-negotiable [10]. Similarly, Kohl’s (KSS) terminated its CEO, Ashley Buchanan, for failing to disclose a romantic relationship that created a clear conflict of interest in business dealings [10].

CEO Failures Stock Performance

Perhaps most dramatically, the family feud at New England grocery chain Market Basket culminated in the board ousting CEO Arthur T. Demoulas, with court filings painting a picture of a dictatorial leader [10]. These incidents, along with the departure of Lululemon (LULU) CEO Calvin McDonald amid public criticism from the company’s founder [10] and the ousting of Nestlé’s CEO for an undisclosed relationship [10], underscore a new era of accountability where personal conduct and governance are under intense scrutiny.

Jobs on the Move

The current leadership churn is creating significant opportunities for aspiring executives. A number of high-profile CEO positions are currently open, reflecting the broader trends of strategic realignment and succession planning. Among the notable openings is the President & CEO role at LeadingAge California, a major advocacy group in the healthcare sector [11]. In the non-profit space, The Moran Company is seeking a President & CEO for a Missouri-based organization [12]. The technology sector also has openings, with The College Board searching for a Senior Director to lead its digital operations platform [13]. These openings, along with numerous unlisted searches being conducted by top executive search firms like WittKieffer and Stanton Chase, indicate a dynamic market for senior leadership talent.

The Watchlist

As boards become more proactive, several companies are on our watchlist for potential succession risks. Companies with long-tenured CEOs, particularly those who also hold the Chairman title, are facing increased pressure to outline clear succession plans. The declining average tenure of departing CEOs, which has dropped by nearly a year to 9.2 years since 2021, suggests that even successful, long-serving leaders are not immune to this trend [9]. Furthermore, companies in the consumer and industrial sectors, which saw the highest turnover rates in 2024 at 12% each, remain under pressure to adapt to changing market dynamics, potentially leading to further leadership changes [9]. We are also closely monitoring companies that have recently experienced significant shareholder activism or public criticism, as these events often precede a change at the top.

Record CEO Exits Timeline

Closing Word

The great recalibration of 2025 is more than just a spike in CEO turnover; it is a fundamental shift in how leadership is evaluated, selected, and held accountable. The data points to a new paradigm where strategic foresight, adaptability, and unimpeachable integrity are the currencies of C-suite longevity. For boards, the challenge is to look beyond short-term performance and identify the leaders who can navigate the complexities of a transformed business landscape. For current and aspiring CEOs, the message is clear: the standards have been raised. The ability to deliver results must be matched by the capacity to lead with vision, embrace change, and uphold the highest standards of governance. The carousel will keep spinning, and only the most agile and principled leaders will stay on for the ride.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded to you? Sign up here.