Editor's Note

It’s Monday, a new week, a new slate, and another opportunity to lead with clarity.

CEOs In The News is a weekly intelligence briefing for senior leaders, boards, and those shaping the future of business. Each edition curates the most important executive moves, corporate shifts, and leadership trends — with clear insights on why they matter.

Our mission is simple: deliver clarity, signal, and strategic perspective in minutes — so you start the week one step ahead of the boardroom narrative.

Executive Moves of the Week

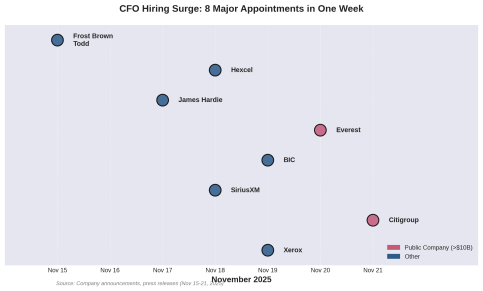

A wave of significant leadership changes swept across the corporate landscape this week, with a notable surge in Chief Financial Officer appointments signaling a strategic realignment in key sectors. Eight major companies, including Citigroup, Xerox, and SiriusXM, named new CFOs in a span of just seven days, pointing to a heightened focus on financial stewardship amid market uncertainty.

Company | Executive | Title | Effective Date | Sector |

Citigroup | Gonzalo Luchetti | Chief Financial Officer | Immediate | Financials |

Xerox | Chuck Butler | Chief Financial Officer | Dec 3, 2025 | Technology |

SiriusXM | Zac Coughlin | Chief Financial Officer | Immediate | Media |

Everest | Elias Habayeb | EVP & Group CFO | Immediate | Insurance |

BIC | Grégory Lambertie | CFO & Digital Officer | Jan 5, 2026 | Consumer Goods |

James Hardie | Ryan Lada | Chief Financial Officer | Immediate | Industrials |

Hexcel | Mike Lenz | Interim CFO | Nov 30, 2025 | Industrials |

Frost Brown Todd | Madhav Srinivasan | Chief Financial Officer | Immediate | Legal |

This flurry of CFO appointments underscores a critical theme: in a volatile economic environment, the CFO role is more strategic than ever. Boards are prioritizing leaders with deep financial acumen and operational experience to navigate market pressures and drive efficiency. The appointments at Citigroup and Xerox, in particular, coincide with major corporate restructuring efforts, highlighting the CFO’s central role in executing strategic pivots.

Beyond the finance function, the pharmaceutical sector continued to see significant churn. AstraZeneca China appointed a new VP from Sanofi, while Alpha-9 Oncology and IAMA Therapeutics brought in new CEOs. These moves reflect the ongoing race for innovation and market share in a highly competitive industry.

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for HNW entrepreneurs and executives. No membership fees. What’s inside:

Self-made professionals, 30-55 years old, $5M-$100M net worth

Confidential discussions, peer advisory groups, live meetups

Institutional-grade investments, $100M+ invested annually

Corporate & Market Shifts

This week, two major corporate shifts highlighted the immense pressure on leadership to adapt to rapidly changing market dynamics. Nokia announced a significant strategic overhaul, including changes to its Group Leadership Team and the creation of a new “Portfolio Businesses” segment to house non-core assets. This move, which aims to sharpen the company’s focus on its core network and mobile infrastructure businesses, is a direct response to the AI-driven transformation of the network industry. The company is betting on a leaner, more focused structure to capture the value of the AI supercycle, setting ambitious new financial targets, including an operating profit goal of €2.7–3.2 billion by 2028.

Simultaneously, Rexford Industrial Realty (NYSE: REXR), a major player in the Southern California industrial real estate market, announced a significant leadership transition and strategic pivot. The appointment of COO Laura Clark as the next CEO, effective April 2026, comes as the REIT confronts a cooling market, with vacancy rates climbing to 6.4% from a historic low of 1.7% in early 2022. Rexford is pausing new development and selling properties to improve cash flow, a defensive maneuver that underscores the challenges facing the industrial real estate sector after a period of supercharged growth.

These shifts at Nokia and Rexford illustrate a broader trend: boards are making decisive leadership and strategic changes to align with new market realities. Whether it’s capitalizing on a technology wave like AI or navigating a cyclical downturn, the message is clear—the status quo is no longer a viable option.

The CEO Lens: The End of the Youthquake? Boards Double Down on Experience

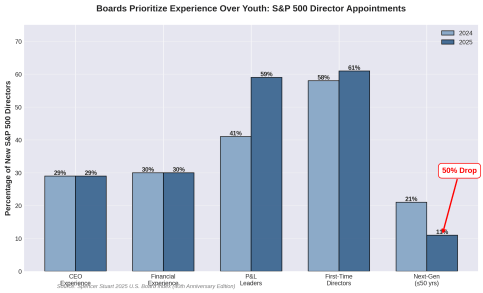

This year’s board appointments reveal a stark reversal of a years-long trend: the corporate world’s romance with youth is officially on ice. Data from the 2025 Spencer Stuart U.S. Board Index shows a dramatic pivot towards seasoned leadership, as boards grapple with unprecedented economic and geopolitical uncertainty. The appointment of “next-gen” directors (aged 50 or under) to S&P 500 boards plummeted by nearly 50%, from 21% of new appointees in 2024 to just 11% in 2025.

In place of youth, boards are overwhelmingly prioritizing proven experience. Nearly 60% of new directors are P&L leaders, a significant jump from 41% last year. The demand for current or former CEOs and those with deep financial expertise remains robust, with these two profiles making up 29% and 30% of new appointments, respectively. This is not a subtle shift; it is a decisive flight to safety. Boards are sending a clear signal that in turbulent times, a steady hand with a track record of navigating crises is the most valuable asset.

This trend echoes historical precedents. During the dot-com bust of the early 2000s and the financial crisis of 2008, boards similarly turned to veteran leaders to steer their companies through the storm. The current environment, characterized by persistent inflation, geopolitical instability, and the disruptive force of AI, is creating a similar sense of urgency. The message from the boardroom is unequivocal: now is not the time for on-the-job training.

The implications for CEO succession and leadership development are profound. Aspiring leaders must now demonstrate not just potential, but a proven ability to manage complexity and deliver results under pressure. The path to the C-suite will likely require a greater emphasis on operational roles and P&L responsibility. For current CEOs, the message is equally clear: the board is looking for stability and predictability. The era of rewarding bold, disruptive visions with unproven track records may be giving way to a renewed appreciation for the quiet competence of experienced leadership.

Leadership Insights

The CFO is Your Co-Pilot in Uncertainty: The surge in CFO appointments is a clear indicator that boards are relying on financial leaders to navigate a complex environment. As CEO, you must treat your CFO as a strategic partner, not just a numbers person. Empower them to challenge assumptions, model different scenarios, and communicate a clear financial narrative to the board and investors. The strength of your partnership with your CFO will be a critical determinant of your company’s resilience in the months ahead.

Succession is a Test of Your Legacy: The cautionary tale of GE’s post-Jack Welch decline serves as a stark reminder that a CEO’s ultimate test is the success of their successor. As highlighted in recent Harvard Business Review research, effective succession planning requires a long-term, deliberate process that prioritizes the company’s future needs over the outgoing CEO’s personal preferences. Are you actively mentoring a diverse slate of internal candidates? Is your board engaged in a rigorous, forward-looking succession process? Your legacy depends on it.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

CEOs Who Got It Wrong

The BBC Leadership Meltdown: A Crisis of Credibility

The abrupt resignations of BBC Director-General Tim Davie and News CEO Deborah Turness on November 9, 2025, represent a catastrophic failure of leadership at one of the world’s most trusted news organizations. The departures came after a blistering wave of criticism over a Panorama documentary that misleadingly edited a speech by Donald Trump, creating a firestorm of accusations of bias and journalistic malpractice.

This was not a simple editorial error; it was a fundamental breakdown of governance and oversight that has severely damaged the BBC’s credibility. The failure to uphold the organization’s core principles of impartiality and accuracy has not only led to the departure of its two most senior leaders but has also triggered a crisis of confidence among the public and its own journalists. For any CEO, this serves as a powerful lesson: your organization’s reputation is your most valuable asset, and it can be shattered in an instant by a failure to enforce the highest standards of integrity.

Jobs on the Move

Chief Executive Officer, Central Alabama Water: The newly formed water utility is seeking its first permanent CEO after a controversial and secretive hiring process for its initial leader sparked public outcry.

Chief Financial Officer, Quanterix: The life sciences company is seeking a new CFO as part of a broader board and leadership shake-up designed to support its next stage of growth.

Chief Marketing Officer, Supergoop!: The fast-growing skincare brand is looking for a new CMO to capitalize on its market momentum after appointing a new CEO.

The Watchlist

CEO Turnover Hits Record Highs

2025 is shaping up to be a year of unprecedented churn in the C-suite. CEO departures are up 19% in the first five months of the year compared to 2024, with a record 1,028 CEOs leaving their posts. This “year of corporate upheaval” is being driven by a confluence of factors, including economic uncertainty, pressure from activist investors, and the personal toll of leading through multiple crises.

Closing Word

In a landscape defined by volatility, the premium on proven, steady leadership has never been higher. The data is clear: boards are retreating from the allure of disruptive youth and placing their bets on the battle-tested wisdom of experience. The central question for every CEO and board is no longer just about navigating the next quarter, but about building an organization with the resilience and leadership to withstand the long storm.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded to you? Sign up here.