Editor's Note

It’s Tuesday, a new week, a new slate, and another opportunity to lead with clarity.

CEOs In The News is a weekly intelligence briefing for senior leaders, boards, and those shaping the future of business. Each edition curates the most important executive moves, corporate shifts, and leadership trends — with clear insights on why they matter.

Our mission is simple: deliver clarity, signal, and strategic perspective in minutes — so you start the week one step ahead of the boardroom narrative.

Executive Moves of the Week

A flurry of high-profile leadership changes rocked the corporate landscape this week, signaling a continued era of strategic realignment and board-level assertiveness. The moves span from Fortune 500 giants to fast-growing tech firms, with a notable emphasis on financial and operational expertise as companies navigate a complex macroeconomic environment.

Company | Executive | Role | Status & Context |

|---|---|---|---|

Northrop Grumman | John Greene | CFO | Appointed – Former CFO at Discover Financial Services; succeeds Ken Crews, who will advise during transition. |

CarMax | Bill Nash | President & CEO | Terminated – Board ousted Nash amid persistent underperformance and a grim Q4 outlook. Board member David McCreight becomes interim CEO. |

Sherwin-Williams | Benjamin E. Meisenzahl | CFO | Appointed – 18-year company veteran promoted from SVP–Finance, succeeding retiring Allen J. Mistysyn. |

EchoStar | Charles W. Ergen | CEO | Appointed – Succeeds Hamid Akhavan, who will now lead new division: EchoStar Capital. |

Kenvue | Kirk L. Perry | CEO | Appointed – After serving as interim CEO since July, now confirmed to lead merger integration with Kimberly-Clark. |

Mohawk Industries | James F. Brunk | CFO | Retiring – After nearly two decades; will retire in April. Nicholas P. Manthey, VP of Corporate Finance, to succeed him. |

Sight Sciences | Ali Bauerlein | COO | Appointed – Former CFO elevated to COO; Jim Rodberg appointed as new CFO. |

Gen Digital Inc. | Bryan Ko | COO | Appointed – Chief Legal Officer expands responsibilities, now also serving as COO. |

Altus Group | Jim Hannon | CEO | Stepping Down – Will be succeeded by Executive Chair Mike Gordon in Q1 as part of planned transition. |

FranConnect | Charlie Zhang | CFO & COO | Appointed – Dual appointment aimed at accelerating AI-driven growth strategy, alongside new Chief Product Officer. |

These moves underscore a critical theme: Boards are no longer waiting for quarterly results to act. They are making decisive, often pre-emptive changes to align leadership with long-term strategy — especially under activist pressure and sector-wide disruption. The retail sector in particular is experiencing dramatic leadership churn, which we explore further below.

Caption: Data from Challenger, Gray & Christmas and WorkLife.news shows a dramatic 116% year-over-year increase in CEO exits within the retail sector, far outpacing other industries and signalling intense pressure on consumer-facing leaders.

Corporate & Market Shifts

This week’s most significant market event was the announcement of Kimberly-Clark’s $48.7 billion acquisition of Kenvue, creating a new consumer health titan with an estimated $32 billion in annual revenue.

The merger brings together iconic brands — Huggies, Kleenex, Tylenol, Band-Aid — forming a portfolio of 10+ billion-dollar brands. For CEOs, this move illustrates the power of strategic consolidation in a market defined by:

• Volatile input costs

• Shifting consumer behavior

• Supply-chain de-risking

Kimberly-Clark CEO Mike Hsu will continue to lead the combined company, ensuring continuity. Three Kenvue board members will join the new board — a hybrid governance model balancing acquirer vision with acquired brand expertise.

This mega-deal aligns with a broader trend of accelerated CEO turnover and strategic realignment across sectors. The S&P 500 has seen a notable uptick in CEO exits compared to last year, even more pronounced globally.

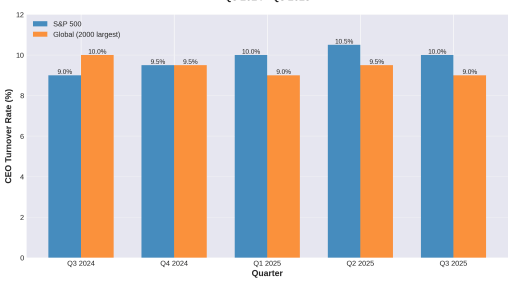

Caption: The Russell Reynolds Global CEO Turnover Index highlights a sustained period of elevated leadership churn. While global turnover has slightly moderated from its peak, the S&P has seen a continued increase in CEO exits through Q , reflecting heightened board scrutiny and activist pressure.

The CEO Lens: The End of the Imperial CEO

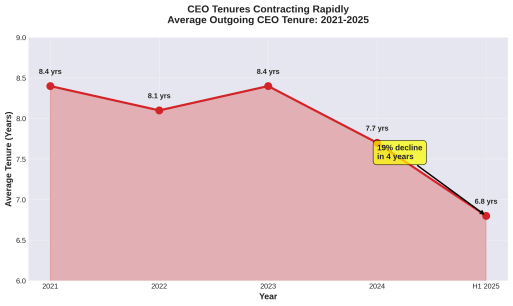

The era of the long-tenured, unassailable CEO is drawing to a close. A confluence of factors - intensified investor activism, relentless technological disruption, and a board-level mandate for agility - is systematically shortening the lifespan of corporate leaders. The data is unequivocal: the average tenure for an outgoing CEO in the first half of was a mere. years, a sharp decline from . years in the same period of and a 19% drop from the .-year highs seen in and.

This compression of CEO tenure is not merely a statistical anomaly; it represents a fundamental shift in the social contract between a CEO and the board. Where once a CEO might have been granted a decade or more to execute a long-term vision, today's leaders are on a much shorter leash. The board's mandate is no longer simply to govern, but to actively manage the strategic alignment of its leadership. This new paradigm is perhaps best understood through the lens of historical precedent.

Consider the case of Lou Gerstner's legendary turnaround of IBM in the s. Gerstner, an outsider from RJR Nabisco, was brought in to save a dying behemoth. His success was predicated on his ability to make radical, often painful, changes to a deeply entrenched culture.

His story is a testament to the power of an external CEO to drive transformation. Yet, today's environment is different. While the need for transformation is constant, the appetite for long, drawn-out turnarounds has diminished. Boards are now expected to act preemptively, to see the writing on the wall long before the company is on the brink of collapse.

Conversely, the failed succession of Jack Welch at General Electric serves as a cautionary tale. Welch, a celebrated CEO, handpicked his successor, Jeff Immelt. Yet, Immelt's tenure was widely seen as a disappointment, and the company's value plummeted. The lesson is clear: even the most successful CEOs are not infallible when it comes to succession. The board's fiduciary duty is to run a rigorous, independent process, not to rubber-stamp the outgoing CEO's choice.

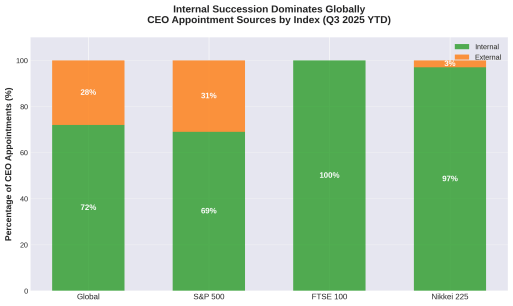

Today's boards are internalizing these lessons. The Russell Reynolds data shows that while 72% of global CEO appointments are internal, a significant number of boards, particularly in the U.S., are turning to external candidates to drive change. This willingness to look outside the organization, combined with the shrinking tenure of those who are appointed, points to a new model of leadership: the agile, adaptable CEO who can deliver results quickly and who understands that their position is not a lifetime appointment, but a tour of duty.

Caption: Data from BCG and Russell Reynolds Associates paints a stark picture of the modern CEO's shortened lifespan. The average tenure of an outgoing CEO has fallen by nearly two years since , a trend that underscores the immense pressure on today's leaders to deliver immediate results.

Leadership Insights

Treat Succession as a Continuous Process, Not a One-Time Event. The data on CEO tenure and turnover makes it clear that succession planning can no longer be a back burner issue. Boards must treat it as an ongoing, strategic imperative. This means identifying and developing a pipeline of internal talent, while also keeping a pulse on the external market. The goal is not simply to have a name-in-an-envelope, but to have a portfolio of well-vetted candidates who are ready to step in at a moment's notice. As the case of CarMax demonstrates, boards that fail to plan for succession are often forced into interim arrangements, which can create a leadership vacuum and prolong uncertainty.

Embrace the First-Time CEO. The data shows a strong trend toward appointing first time public company CEOs, with 88% of global appointments in falling into this category. This is not a sign of desperation, but a strategic choice. Boards are betting on rising leaders who bring fresh perspectives, a high degree of adaptability, and a willingness to challenge the status quo. For current CEOs and boards, this means that the next leader may not be a seasoned veteran, but a high-potential executive from within their own ranks or a rising star from a competitor. The key is to identify these individuals early, invest in their development, and create opportunities for them to demonstrate their leadership capabilities.

Caption: An overwhelming majority of new CEOs are first-timers, a trend that holds true across major global indices. The notable exception is the S&P , where activist pressure has led to a greater reliance on experienced external hires to steady the ship.

CEOs Who Got It Wrong: Bill Nash at CarMax

The abrupt termination of CarMax CEO Bill Nash serves as a stark reminder that even in a challenging market, boards have little patience for underperformance. The company's press release, stating that "change is needed," was a clear and public rebuke of Nash's leadership. The board's decision was driven by a disastrous Q outlook, with projected earnings of $0.18.-0.36$. per share—a massive miss compared to the consensus estimate of $0.71.. This followed a significant miss in Q, painting a picture of a company in a steep and accelerating decline.

The failure at CarMax is a case study in the inability to adapt to a rapidly changing market. The company was caught flat-footed by a number of headwinds: a sharp depreciation in wholesale used car prices, softening consumer demand, and the failure of anticipated auto tariffs to inflate used car values. While these external factors were significant, the board's decision to oust Nash suggests a deeper dissatisfaction with his strategic response. The fact that no internal successor was named, and that a board member was appointed as interim CEO, speaks volumes about the board's lack of confidence in the existing senior management team.

For CEOs, the lesson from CarMax is twofold. First, you cannot control the market, but you are expected to control your company's response to it. A reactive, wait-and-see approach is a recipe for disaster. Second, transparency with the board is critical. The scale of the Q miss suggests a significant disconnect between management's forecasts and the reality on the ground. When the bad news finally hit, it was too late for Nash to save his job.

Jobs on the Move

CarMax: President & CEO. Following the termination of Bill Nash, the company has engaged Russell Reynolds to conduct a search for a new leader who can navigate the challenging used car market and restore investor confidence.

Altus Group: CEO. With Jim Hannon stepping down, the real estate services firm is preparing for Mike Gordon to take the helm in Q . The search for his successor as Executive Chair will be a key focus.

Non-Profit Sector: Chief Financial Officer. A number of prominent non-profits, including Code.org, are seeking CFOs with deep experience in financial stewardship and strategic leadership.

Healthcare: Interim Leadership Roles. The high rate of CEO turnover in the healthcare sector has created a surge in demand for experienced interim executives who can provide stability and operational leadership during periods of transition.

The Watchlist

Succession Risk at Disney: The ongoing drama surrounding Bob Iger and his successor is a high-stakes case study in succession planning. The board is under immense pressure to get it right this time, and the industry is watching closely to see who will ultimately be tapped to lead the media giant into the future.

Rising Leaders in Tech: Keep an eye on the next generation of leaders at companies like Google, Microsoft, and Amazon. As the founders and long-tenured CEOs of the first wave of tech giants begin to step back, a new cohort of leaders is emerging. Their ability to navigate the complexities of AI, regulation, and global competition will define the next chapter of the industry.

The Future of the CHRO: The role of the Chief Human Resources Officer is evolving from a support function to a strategic partner. As companies grapple with talent shortages, hybrid work models, and a renewed focus on culture, the CHRO is becoming an increasingly critical member of the C-suite. The decline in internal succession for this role suggests that boards are looking for a new breed of HR leader with a broader, more strategic skill set.

Caption: While internal succession remains the most common path to the CEO role globally, the S&P shows a greater willingness to hire externally compared to other major indices. This reflects a trend of boards seeking outside disruptors to drive change and respond to market pressures.

Closing Word

The modern CEO is operating in an environment of unprecedented volatility. The margin for error is shrinking, and the timeline for delivering results is contracting. The leaders who will succeed in this new era are not those who have all the answers, but those who have the agility to adapt, the courage to make bold decisions, and the humility to recognise that their tenure at the top is, more than ever, a temporary stewardship.

Free email without sacrificing your privacy

Gmail is free, but you pay with your data. Proton Mail is different.

We don’t scan your messages. We don’t sell your behavior. We don’t follow you across the internet.

Proton Mail gives you full-featured, private email without surveillance or creepy profiling. It’s email that respects your time, your attention, and your boundaries.

Email doesn’t have to cost your privacy.

Was this email forwarded to you? Sign up here.