Editor's Note

It’s Monday, a new week, a new slate, and another opportunity to lead with clarity.

CEOs In The News is a weekly intelligence briefing for senior leaders, boards, and those shaping the future of business. Each edition curates the most important executive moves, corporate shifts, and leadership trends — with clear insights on why they matter.

Our mission is simple: deliver clarity, signal, and strategic perspective in minutes — so you start the week one step ahead of the boardroom narrative.

Executive Moves of the Week

The boardroom revolving door is spinning with purpose. This week saw a clear divergence between boards executing deliberate, long-term succession plans and those forced into reactive, crisis-driven changes.

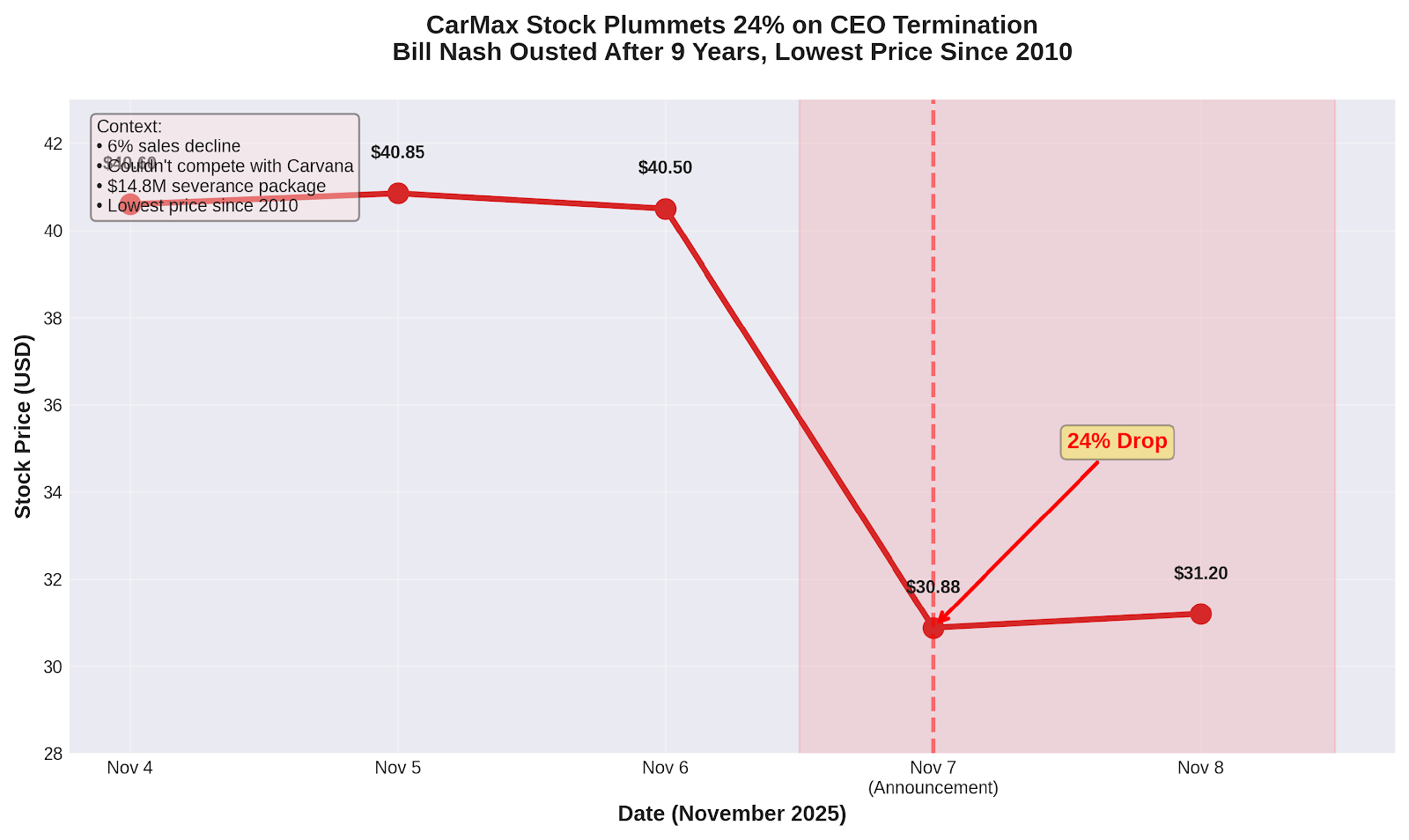

Walmart provided a masterclass in the former, announcing that CEO Doug McMillon will retire on January 31, 2026, to be succeeded by Walmart U.S. CEO John Furner. The multi-year transition, with McMillon staying on as an advisor, signals stability and strategic continuity. In contrast, CarMax terminated CEO Bill Nash after nine years, triggering a 24% stock plunge to a 15-year low. The move, a direct response to a 6% sales decline and failure to compete with digital-native rivals, underscores the market’s brutal punishment for strategic inertia [1, 6].

Other key moves underscore the dominant trends:

Internal Promotions: Ball Corporation elevated its Chief Supply Chain Officer, Ronald J. Lewis, to CEO and made interim CFO Daniel J. Rabbit permanent. Protective Life promoted Paul Wells to President/CFO and Wade Harrison to Vice Chairman/COO, distributing leadership responsibilities. West Marine also promoted its COO, Paulee Day, to the top job [1, 3, 4].

External Hires for Transformation: Diageo brought in Dave Lewis as CEO to reverse a sales slowdown, while P.F. Chang’s hired Jim Mazany to navigate the digital-first restaurant landscape [2, 5].

The Talent War: Intel lost its Chief Technology and AI Officer, Sachin Katti, to OpenAI, a stark reminder of the intense competition for top AI talent [1].

Company | Incoming/Outgoing Leader | Role | Key Takeaway |

|---|---|---|---|

Walmart | John Furner (In) | CEO | Gold-standard internal succession; long-term planning. |

CarMax | Bill Nash (Out) | CEO | Failure to adapt to market disruption leads to termination. |

Ball Corporation | Ronald J. Lewis (In) | CEO | Board confidence in its internal leadership bench. |

Diageo | Dave Lewis (In) | CEO | External hire brought in to drive a turnaround. |

Intel | Sachin Katti (Out) | CTO / AI | Top tech talent remains highly mobile and in demand. |

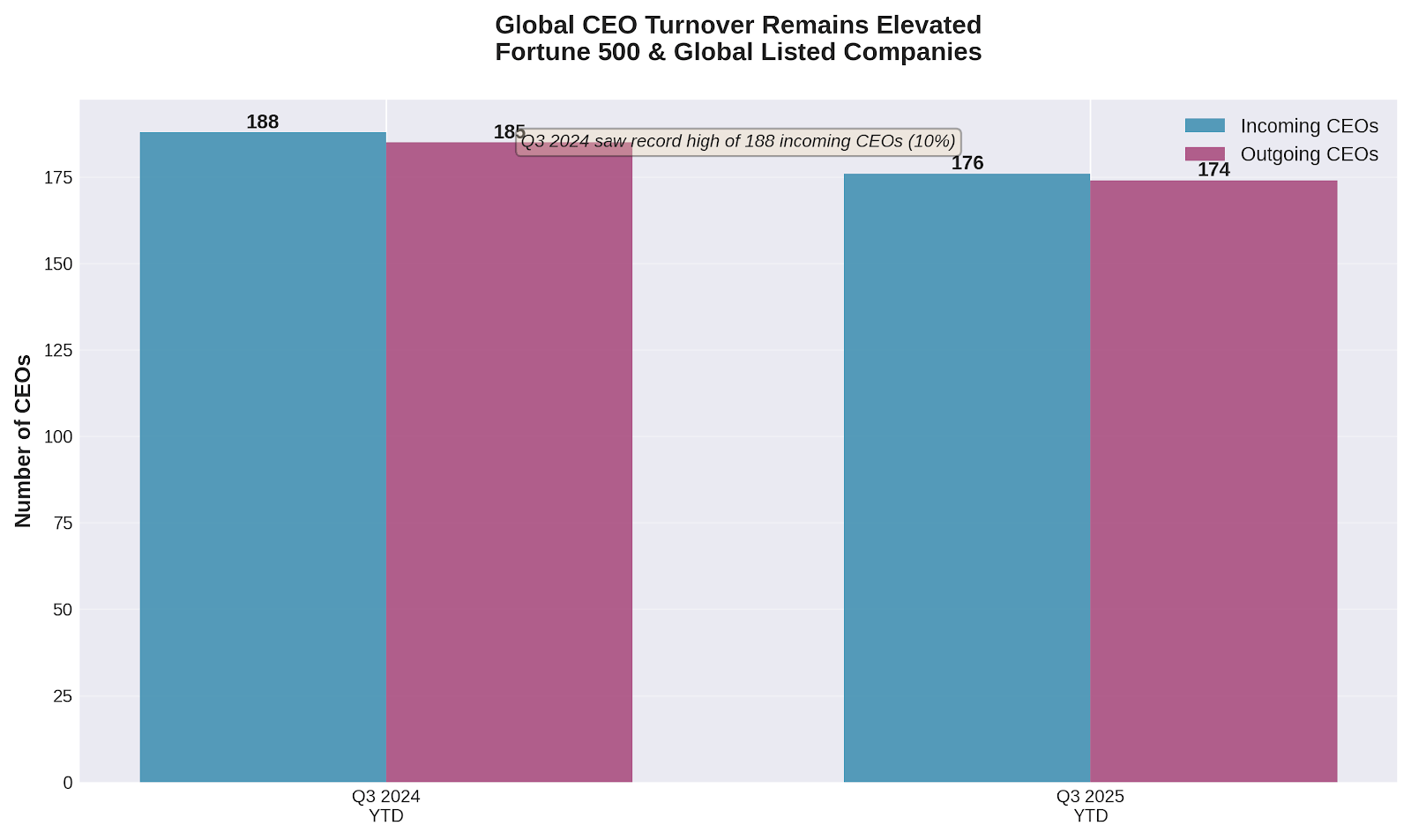

Caption: Global CEO turnover remains elevated in 2025, with 176 incoming CEOs through Q3. The sustained high turnover reflects boards’ increasing willingness to make decisive leadership changes. [1]

Proton Mail gives you a clutter-free space to read your newsletters — no tracking, no spam, no tabs.

Corporate & Market Shifts

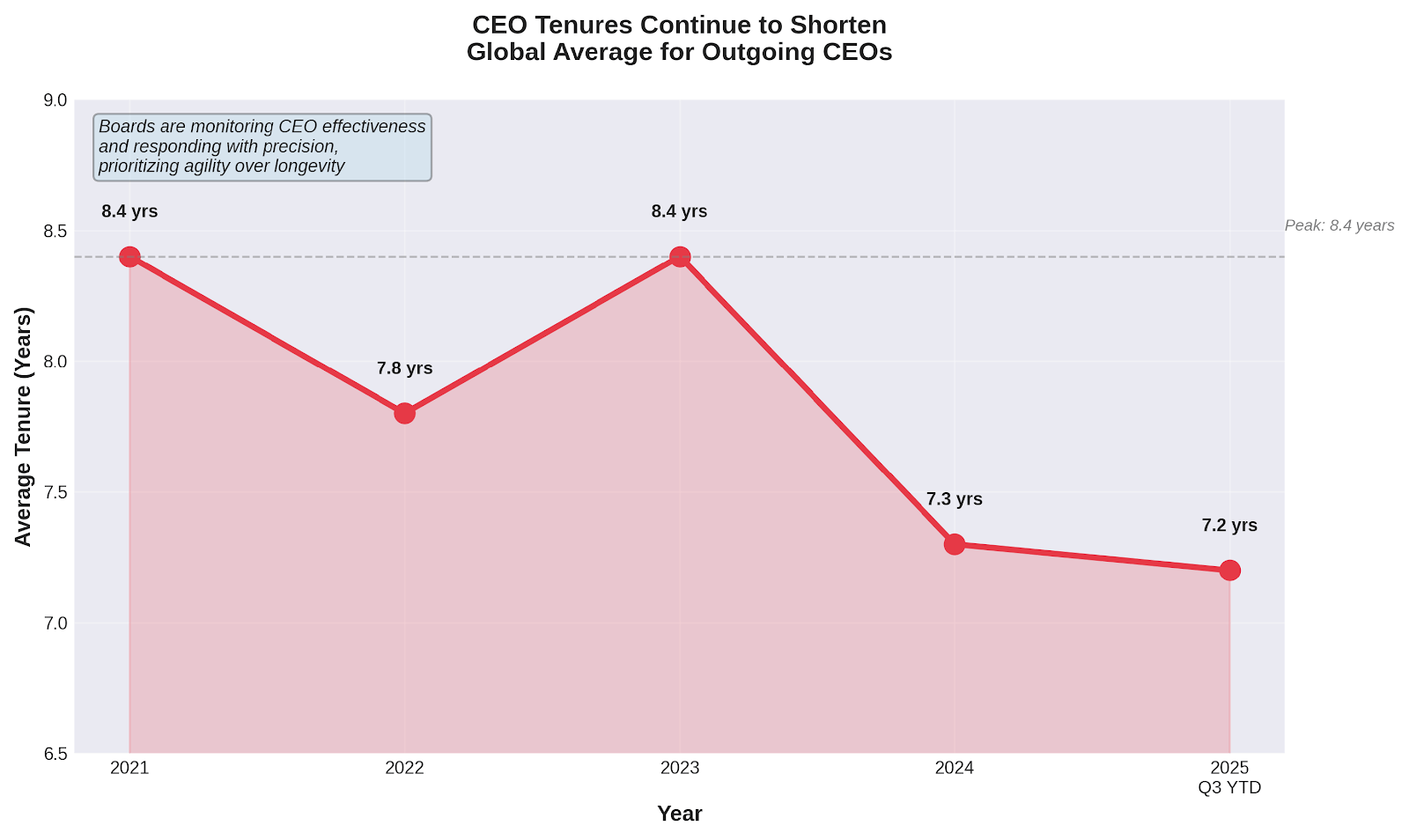

Two forces are driving the current C-suite volatility: the strategic imperative of long-term succession planning and the immediate pressure from activist investors. Global CEO turnover remains near record highs, with an average tenure for outgoing CEOs shrinking to 7.2 years, down from a peak of 8.4 years [1]. Boards are acting with greater urgency.

This urgency is fueled by a surge in activist campaigns, which are up 19% globally versus the long-term average. Investors are no longer waiting for boards to act on underperformance. The result is a market that rewards foresight and punishes delay. Walmart’s seamless transition plan for McMillon to Furner is a prime example of the former, insulating the company from the kind of shock that erased billions in market value at CarMax overnight.

Caption: The average tenure of outgoing CEOs has declined to 7.2 years in 2025. Boards are acting earlier in the CEO lifecycle, prioritizing agility over longevity. [1]

The CEO Lens: The Rise of the First-Time CEO

A striking 88% of CEOs appointed globally in 2025 are leading a public company for the first time, up from 85% in 2024 [1]. This is not a marginal shift; it is a fundamental change in how boards define leadership. In an era of constant disruption, boards are betting on adaptability over experience, potential over polish.

This trend is particularly pronounced in the FTSE 100 (100% first-time CEOs) and the Nikkei 225 (97%). It stands in stark contrast to historical precedents like IBM’s 1993 hiring of outsider Lou Gerstner to save the company—a bet on a seasoned executive to fix a broken culture [7]. Today, boards are more inclined to trust their internal pipelines, believing that deep company knowledge combined with a fresh perspective is the key to navigating complexity.

Why should a CEO care? This trend has two profound implications. First, building a deep internal leadership pipeline is no longer a “nice-to-have”; it is a primary strategic asset. Second, for aspiring leaders, demonstrating agility and the capacity to lead through complexity is now more valuable than a traditional, linear career path. The data shows that boards are willing to bet on the leader who can build the future, not just manage the present.

Caption: A significant majority of new CEO appointments in 2025 are first-time public company leaders, highlighting a global trend toward promoting internal talent with fresh perspectives. [1]

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Leadership Insights

Treat Succession as a Continuous Process, Not a Crisis. With CEO tenures shrinking, boards must abandon the reactive approach to succession. The data shows only 35% of directors feel they have enough time for succession planning [8]. Why care? Your legacy is defined by the strength of the leadership you leave behind. Proactively partnering with the board on a continuous succession strategy ensures a stable transition and protects shareholder value.

Make Enterprise-Level Exposure a Prerequisite. The rise of the internal, first-time CEO means functional expertise is not enough. Aspiring leaders need “stretch” assignments that provide P&L responsibility and strategic decision-making outside their core domain. Why care? Deliberately rotating top talent builds a bench of leaders who think like enterprise leaders, ensuring your pipeline is filled with candidates who are truly ready to lead.The Stakeholder Communication Imperative

The shift toward preemptive CEO changes also reflects the evolution of stakeholder communication requirements in the current business environment. Modern boards must manage relationships with institutional investors, activist shareholders, employees, customers, and regulatory bodies that have different information needs and reaction patterns. Poor earnings combined with leadership uncertainty creates communication challenges that can persist for quarters, affecting everything from employee retention to customer confidence.

By separating leadership transitions from earnings announcements, boards can control the narrative around both events more effectively. Leadership changes can be positioned as proactive strategic decisions rather than reactive responses to poor performance. Earnings announcements can focus on operational results and forward guidance rather than being overshadowed by leadership uncertainty.

This approach requires boards to develop more sophisticated succession planning capabilities and performance monitoring systems. Rather than waiting for annual reviews or obvious performance failures, boards must continuously assess CEO effectiveness and maintain readiness for leadership transitions. This represents a significant evolution in board governance practices and time allocation.

CEOs Who Got It Wrong

Case Study: Bill Nash, CarMax (Terminated November 2025)

The termination of CarMax CEO Bill Nash is a cautionary tale about the perils of strategic stagnation. After a 30-year career with the company, including nine as CEO, Nash was ousted by a board that had lost patience with declining performance and the company’s failure to compete with digital-first rivals like Carvana [6].

The market’s judgment was swift and brutal: a 24% stock plunge to a 15-year low. The board’s decision to approve a $14.8 million severance package while simultaneously removing Nash underscores the high cost of waiting too long to act.

Why should a CEO care? Nash’s ousting demonstrates that deep institutional knowledge is worthless without strategic adaptation. The board’s move is a clear signal that even respected, long-serving CEOs will be held accountable for failing to navigate market disruption.

Caption: CarMax’s stock price fell 24% immediately following the announcement of CEO Bill Nash’s termination, reflecting investor concern over the company’s performance and strategic direction. [6]

Jobs on the Move

President & CEO, Boys & Girls Clubs of Greater Washington: High-profile non-profit leadership role requiring significant fundraising and community engagement experience [9].

President and CEO, Higher Education Institution: Search underway for a university president, demanding both academic and administrative leadership [10].

COO/CFO, Global Agricultural Products Leader: A dual-role executive search to drive operational and financial excellence during a period of transformative growth [11].

The Watchlist

The primary risk on the watchlist is the insularity trap. While internal promotions are dominant (72% globally), they can breed a lack of external perspective. The S&P 500 is a key indicator to watch, as its rate of internal succession has dropped from 79% to 69% in the past year, suggesting U.S. boards are more willing to look externally to find the skills needed to navigate disruption [1]. This contrasts with the FTSE 100 and Nikkei 225, which remain heavily reliant on internal pipelines.

A recent Harvard Business Review study identified ten common pitfalls in CEO succession, including CEO resistance and a failure to align the CEO profile with future strategy. With only 26% of directors feeling confident they have enough time for succession, the risk of a mishandled transition is high [8].

All eyes are on Walmart’s transition from McMillon to Furner. Its success—or failure—will provide critical lessons for boards across every sector.

Caption: While internal succession remains the dominant global trend, the S&P 500 has seen a notable increase in external hires, indicating a greater willingness among U.S. boards to seek outside talent. [1]

Closing Word

The message from this week’s data is unequivocal: the CEO’s chair is hotter, the tenure is shorter, and the demand for agile, transformative leadership has never been greater. The most resilient organizations will be those whose boards treat leadership succession not as a periodic crisis, but as a perpetual strategic imperative.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded to you? Sign up here.