Editor's Note

Thursday is where the week’s real story comes into focus.

While Monday sets the tone, Thursday reveals the underlying trends — the leadership decisions, market movements, and strategic shifts that signal where industries are heading next. This edition distills those developments into clear, actionable insight for senior leaders, board members, and anyone responsible for shaping strategy in a volatile environment.

Our purpose is simple: deliver clarity, signal, and forward-looking perspective — so you can finish the week with sharper judgment and stronger strategic footing.

Executive Summary

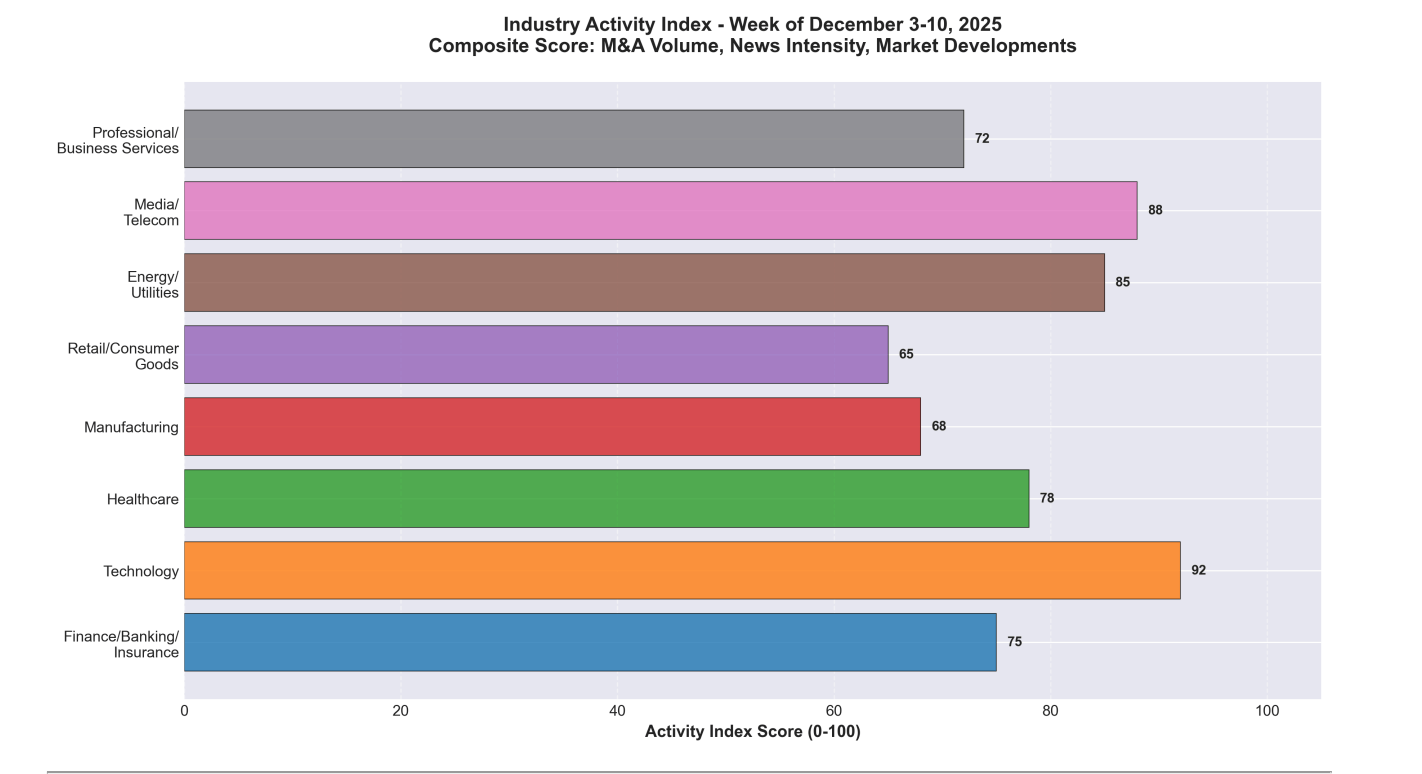

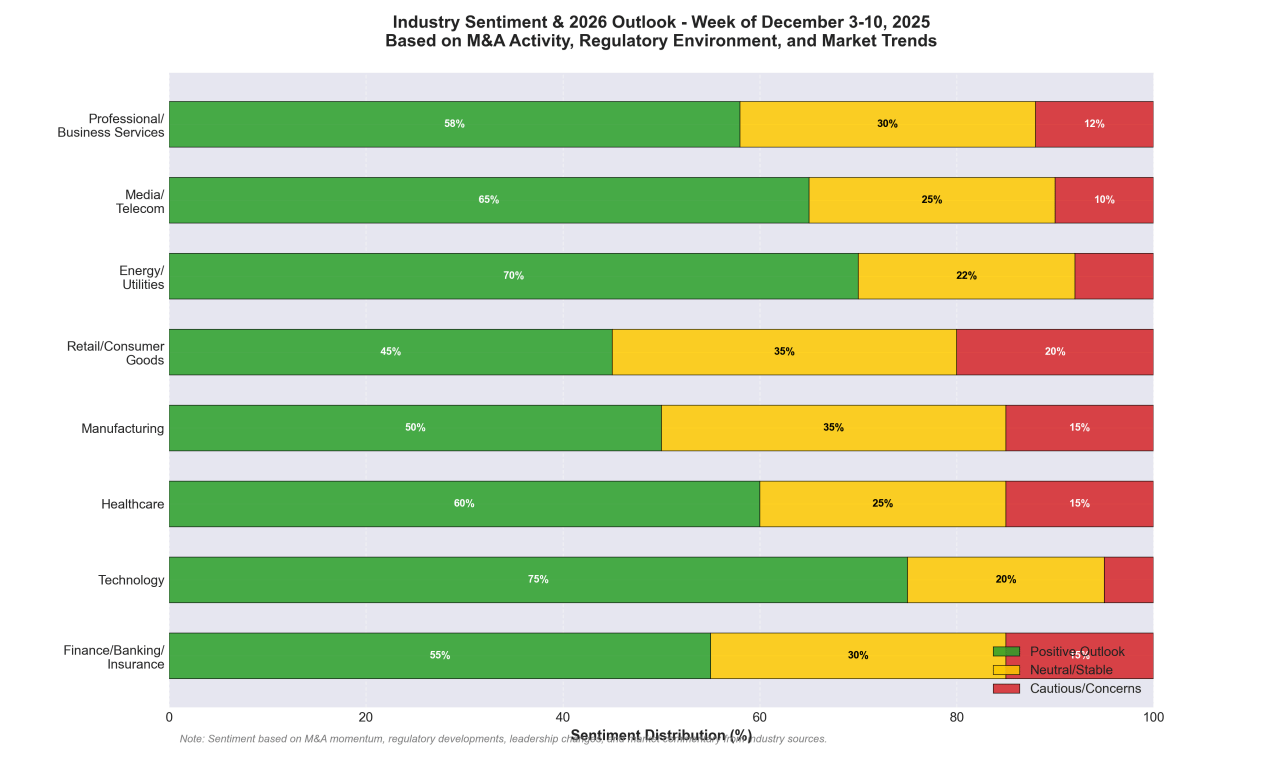

The past week has been marked by a potent convergence of transformative forces across the global industrial landscape. A record-breaking surge in Merger and Acquisition (M&A) activity, primarily fueled by an insatiable appetite for Artificial Intelligence (AI) capabilities, has dominated headlines and strategic planning. This wave of consolidation is occurring within a complex and shifting regulatory environment, as governments worldwide grapple with the implications of AI, data privacy, and market concentration. Concurrently, significant leadership transitions at major corporations signal a broader strategic realignment in response to these powerful market dynamics. This edition of “Industry Recap & News” delves into these dominant themes, providing a PhD-level analysis of the developments shaping all eight major sectors.

Technology: The Unrelenting AI-Fueled M&A Boom

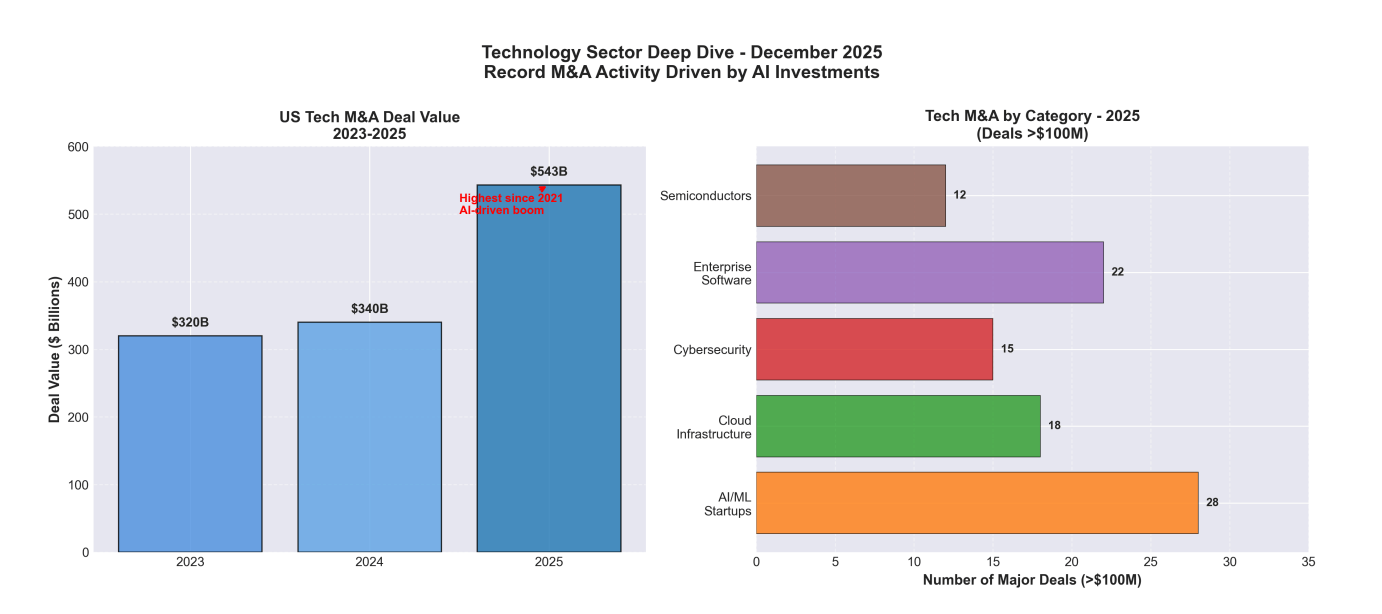

The technology sector was the epicenter of market activity this week, driven by an unprecedented M&A boom that has redefined the competitive landscape. Total US tech M&A deal value for 2025 has soared to $543 billion, the highest level seen since the market peak of 2021 and representing a staggering 60.2% year-over-year increase [1]. The global figure is even more striking, with technology dealmakers hitting a $1 trillion record amidst the AI gold rush [2]. This frenetic pace of dealmaking underscores a fundamental strategic imperative: the acquisition of AI talent and technology is no longer a luxury but a critical component of corporate survival and growth.

Technology Sector Deep Dive

Leading the charge are investment banking giants Goldman Sachs and Qatalyst Partners, who have emerged as the primary architects of this consolidation wave [1]. The surge is not merely in value but also in volume, with a notable increase in deals exceeding $100 million, particularly in categories like AI/ML startups, cloud infrastructure, and cybersecurity. The venture capital landscape reflects this trend, with significant funding rounds for AI-centric companies. Unconventional AI, a promising startup in the generative AI space, confirmed a massive $475 million seed round, while Fal, another AI-focused entity, secured $140 million in fresh funding [3]. This influx of capital is not just funding innovation but also fueling an intense talent war, as established players and startups alike vie for top-tier AI expertise.

This technological upheaval is unfolding against a backdrop of significant regulatory uncertainty. The Trump administration is reportedly planning a “One Rule” executive order aimed at federalizing AI regulation, a move intended to preempt a patchwork of state-level laws [4]. A leaked draft of the order suggests a clear intent to create a unified national framework, a proposal that has been met with intense lobbying from Silicon Valley. This push for federal oversight highlights the growing tension between fostering innovation and mitigating the potential risks associated with advanced AI systems. The outcome of this regulatory debate will have profound and lasting implications for the development and deployment of AI technologies across all sectors.

Executive leadership changes further reflect the industry’s strategic pivot. In a significant move, OpenAI has hired former Slack CEO Denise Dresser as its new Chief Revenue Officer, signaling a heightened focus on commercialization and enterprise adoption [5]. Meanwhile, Apple is undergoing a major leadership overhaul, appointing new heads of AI, design, and operations in a clear move to prepare for the post-Tim Cook era and double down on its AI ambitions [6]. These high-profile appointments underscore the critical importance of seasoned leadership in navigating the complex interplay of technological innovation, market competition, and regulatory scrutiny.

Media & Telecommunications: A New Era of Mega-Consolidation

The media and telecommunications sector is in the throes of a dramatic consolidation war, highlighted by the blockbuster announcement of Netflix’s proposed $72 billion acquisition of Warner Bros. Discovery [7]. This monumental deal, which immediately drew a hostile counter-bid from Paramount, signals a new phase in the streaming wars, where scale and content library depth are paramount. As Stanford economist Ali Yurukoglu noted, while media mega-mergers are not new, this is the first to involve Netflix, a disruptive force now behaving like a traditional media titan to secure its market dominance [7]. The proposed merger is expected to face intense antitrust scrutiny, with regulators examining its potential impact on consumers, advertisers, and content creators in a landscape already dominated by giants like Disney, Amazon, and Apple.

The strategic imperative behind this consolidation is clear: to control both content creation and distribution. The deal would unite Netflix’s global streaming platform with Warner Bros.’ iconic film and television studios, creating an entertainment behemoth with unparalleled reach and a vast intellectual property portfolio. This move is a direct response to the escalating costs of content production and the intense competition for subscriber attention. The outcome of this high-stakes battle will not only determine the future of the streaming market but also has significant implications for the traditional moviegoing experience, as Netflix’s historical preference for streaming-first releases could further erode theatrical attendance [7].

Beyond the streaming wars, the telecommunications infrastructure is also undergoing significant shifts. The Federal Communications Commission (FCC) approved AT&T’s $1.02 billion acquisition of spectrum from UScellular, a move that will enhance the carrier’s 5G network capacity [8]. However, the approval came with a notable condition: AT&T must terminate its Diversity, Equity, and Inclusion (DEI) initiatives, a controversial stipulation that highlights the politicization of regulatory processes. This deal is part of a broader trend of convergence and consolidation across the communications sector, as companies position themselves for an AI-driven, 5G-enabled future. The strategic merger between Cobham Satcom and Gatehouse Satcom to bolster 5G non-terrestrial networks (NTN) further illustrates this trend, as the industry pushes to extend connectivity to remote and underserved areas [9].

Energy & Utilities: Fueling the Future, from AI to Natural Gas

The Energy and Utilities sector is experiencing a blockbuster year for M&A, driven by a dual focus on expanding renewable energy capabilities and strategically consolidating natural gas assets. The sector’s activity is intrinsically linked to the technology boom, as the voracious energy demands of AI and data centers are creating a new and rapidly growing market for power generation. US utilities are on a dealmaking spree to lock in supply for data centers, with NextEra Energy aiming to build up to 30 GW in dedicated power supply hubs by 2035 [10].

In a landmark deal underscoring the strategic importance of natural gas as a bridge fuel, NextEra Energy Resources announced its acquisition of Symmetry Energy Solutions from Energy Capital Partners for an estimated $800 million [11]. This acquisition expands NextEra’s natural gas capabilities, complementing its significant investments in pipeline infrastructure and renewable energy. The move reflects a broader industry trend of leveraging natural gas to ensure grid stability and meet rising demand, even as the transition to clean energy accelerates. The sharp resurgence in natural gas power generation M&A in 2025 is fueled by expectations of outsized load growth and elevated power prices [12].

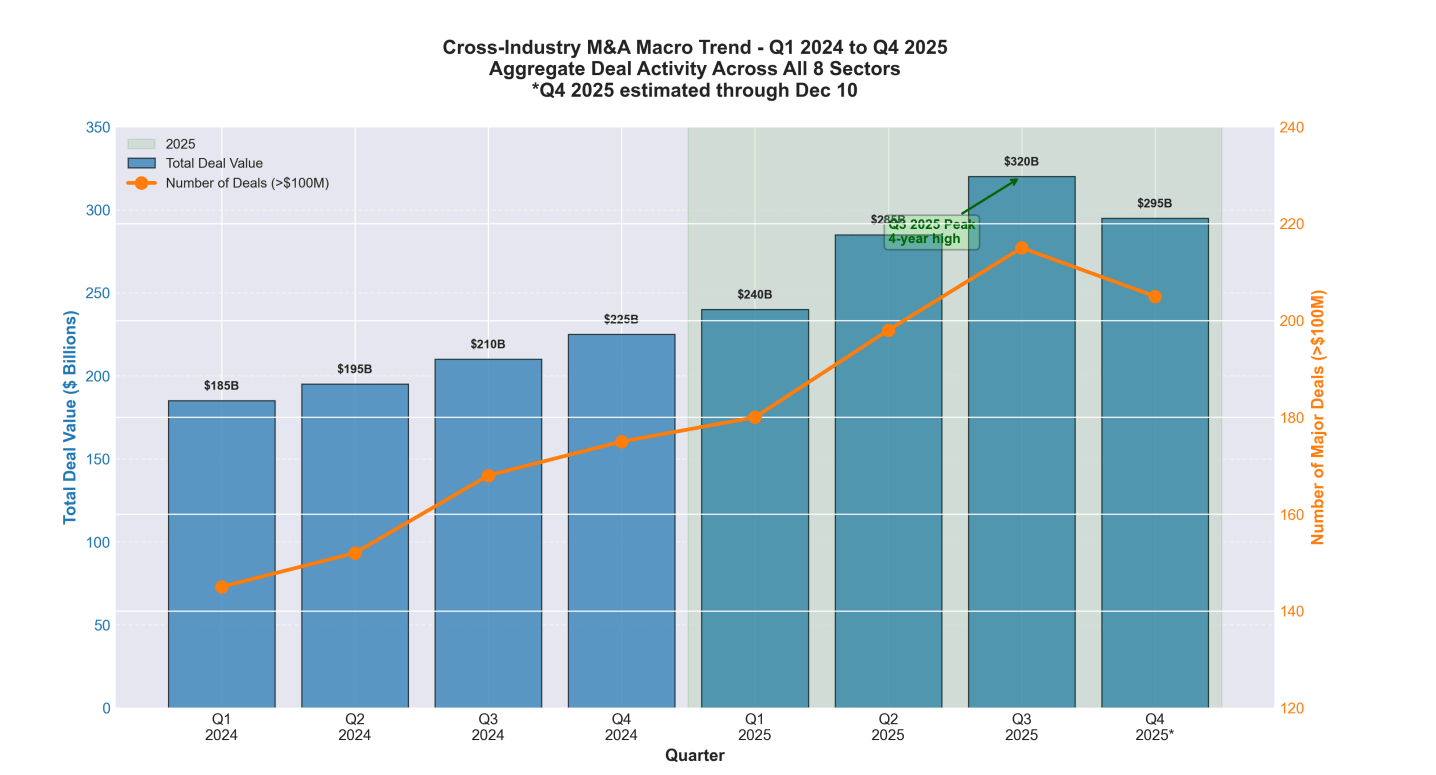

This M&A activity is occurring within a favorable financial environment. The Americas M&A market hit a four-year high in Q3 2025, driven by strategic, long-view acquisitions in the energy sector [13]. The push for consolidation is also being shaped by regulatory forces, including new methane emissions rules and the Inflation Reduction Act, which are reshaping the economics of energy production and investment. The rising volume of US Liquefied Natural Gas (LNG) exports is another critical factor, pushing domestic natural gas prices toward global benchmarks and creating both opportunities and challenges for US consumers and industries [14]. The sector’s ability to balance the demands of the energy transition with the immediate need for reliable power for critical infrastructure like data centers will be a defining challenge in the years to come.

Finance, Banking & Insurance: Navigating a Dynamic M&A and Regulatory Landscape

The financial sector is navigating a period of dynamic evolution, characterized by a slight cooling of M&A activity in the short term, juxtaposed with a highly optimistic outlook for 2026. While US bank M&A activity mellowed in November, with 11 deals announced totaling a combined $6.41 billion in target assets, the broader trend points toward a resurgence of large-scale dealmaking [15]. A record-setting 63 deals worth $10 billion or more were announced in 2025 through late November, and top investment banks like Goldman Sachs are poised to benefit from what is expected to be a record M&A cycle in the coming year [16]. This momentum is fueled by a rush to the bond markets for M&A funding, with massive debt-fueled deals making a notable comeback on Wall Street [17].

In the insurance sub-sector, consolidation is also a dominant theme. Independent insurance agencies The Baldwin Group and CAC Group have agreed to a $1.026 billion merger, a deal that will create one of the largest independent insurance advisory and distribution platforms in the United States [18]. This move is indicative of a broader trend toward specialization and scale, as firms seek to enhance their capabilities and expand their market reach. The transaction, expected to close in the first quarter of 2026, will form the largest majority colleague-owned publicly traded insurance broker in the country.

This wave of consolidation is unfolding amidst a shifting regulatory framework. In the United Kingdom, the Financial Conduct Authority (FCA) has announced measures to simplify insurance regulations and cut “red tape” for insurers, a move aimed at reducing compliance costs [19]. In the US, the National Association of Insurance Commissioners (NAIC) is implementing a new framework for regulatory credit ratings, effective January 1, which will grant state regulators more leeway to challenge credit ratings [20]. Meanwhile, the Consumer Financial Protection Bureau (CFPB) is in the process of issuing new regulations governing open banking, a development that will have far-reaching implications for data sharing and competition in the financial services industry. These regulatory shifts, coupled with the ongoing M&A activity, are creating a complex and challenging environment for financial institutions, requiring them to be both agile and strategically forward-thinking.

Healthcare: The Race for Innovation and Market Share

The healthcare sector is on the cusp of a significant M&A ramp-up, with industry experts predicting a surge in dealmaking in 2026, driven by anticipated interest rate cuts and a more merger-friendly regulatory environment [21]. This optimistic outlook is tempered by the pressing challenges of rising costs and evolving patient needs. One of the most intensely competitive arenas is the weight-loss drug market, where a host of biotech firms are racing to challenge the dominance of Novo Nordisk and Eli Lilly [22]. The immense commercial potential of these drugs is fueling a wave of research and development, as companies vie for a share of this lucrative and rapidly expanding market.

However, the path to innovation is not without its setbacks. Novo Nordisk recently announced that its closely watched Alzheimer’s trials of an older oral version of its semaglutide drug failed to meet their primary endpoint, a disappointing result that sent the company’s shares tumbling [23]. This outcome underscores the high-risk, high-reward nature of pharmaceutical research and the immense challenges of developing effective treatments for complex neurodegenerative diseases. Despite this setback, the broader biopharma sector remains a hotbed of activity, with significant deals like China’s Sichuan Kelun-Biotech licensing an experimental cancer treatment to Crescent Biopharma for $80 million upfront and up to $1.25 billion in potential milestones [24].

The healthcare landscape is also being reshaped by significant policy changes. The “One Big Beautiful Bill Act” is set to restructure Medicaid, with phased-in changes beginning on January 1, 2027, that will raise uncompensated care costs and increase compliance demands on hospitals [25]. This legislative overhaul, combined with the fact that health insurance premiums have risen at nearly three times the rate of worker earnings over the past 25 years, is putting immense pressure on both providers and patients [26]. As the sector grapples with these economic and regulatory headwinds, the focus on strategic consolidation and innovative solutions to improve efficiency and patient outcomes will only intensify.The Watchlist

The primary risk on the watchlist is the insularity trap. While internal promotions are dominant (72% globally), they can breed a lack of external perspective. The S&P 500 is a key indicator to watch, as its rate of internal succession has dropped from 79% to 69% in the past year, suggesting U.S. boards are more willing to look externally to find the skills needed to navigate disruption [1]. This contrasts with the FTSE 100 and Nikkei 225, which remain heavily reliant on internal pipelines.

A recent Harvard Business Review study identified ten common pitfalls in CEO succession, including CEO resistance and a failure to align the CEO profile with future strategy. With only 26% of directors feeling confident they have enough time for succession, the risk of a mishandled transition is high [8].

All eyes are on Walmart’s transition from McMillon to Furner. Its success—or failure—will provide critical lessons for boards across every sector.

Manufacturing: Investing in Domestic Production and High-Tech Capabilities

The manufacturing sector is demonstrating a renewed focus on domestic production and technological advancement, marked by significant capital investments and strategic acquisitions. In a major deal highlighting the consolidation trend in the industrial space, ITT Inc. announced its acquisition of SPX FLOW Inc. for nearly $4.8 billion [27]. This acquisition of the Charlotte-based industrial equipment manufacturer from Lone Star Funds represents a significant bet on the long-term growth of the industrial sector and the increasing demand for specialized, high-tech components.

This trend of domestic investment is further exemplified by major commitments from the automotive industry. General Motors announced a $4 billion investment over the next two years in its manufacturing plants in Michigan and Kansas, a move aimed at modernizing its facilities and increasing its production capacity for next-generation vehicles [28]. Similarly, in the aerospace sector, Otto Aviation is investing over $430 million to build a new 850,000-square-foot assembly plant in Jacksonville, Florida, signaling a strong belief in the future of advanced aviation technologies [29]. These large-scale investments underscore a broader strategic shift toward strengthening domestic supply chains and enhancing manufacturing capabilities within the United States.

The sector’s evolution is also being profoundly shaped by the integration of AI, data analytics, and IoT technologies. These advancements are redefining what is possible in high-precision production and automation, leading to significant gains in productivity and efficiency. While overall industrial production saw a modest increase of 0.1% in September, the underlying trend is one of rapid technological adoption [30]. However, this period of transformation is not without its challenges. A new report from the Association of Equipment Manufacturers highlights that rising uncertainty is fundamentally reshaping the equipment manufacturing sector, forcing companies to adapt to new distribution models and evolving customer demands [31]. The ability to successfully navigate this complex environment, by embracing new technologies while managing economic uncertainties, will be the key determinant of success for manufacturing firms in the coming years.

Retail & Consumer Goods: A Cautious but Resilient Consumer Navigates Holiday Season

The Retail and Consumer Goods sector is navigating a complex holiday shopping season, characterized by a consumer who is both resilient and increasingly calculated in their spending. While Black Friday retail sales (excluding auto) rose a healthy 4.1% year-over-year, with e-commerce sales surging 10.4%, the broader trend suggests a more cautious consumer mindset [32]. Deloitte recently revealed that American consumers are expected to spend 10% less on their holiday shopping this year, a direct consequence of inflationary pressures and the impact of tariffs on consumer goods prices [33]. This dichotomy between strong headline numbers and underlying consumer caution is forcing retailers to be more strategic and promotional to capture their share of the holiday spending, which is still on track to cross the $1 trillion mark [34].

The earnings reports from the past week paint a mixed picture of the sector’s health. While some retailers are thriving, others are struggling to adapt to the changing consumer landscape. GameStop’s stock sank on a significant earnings miss, and Cracker Barrel’s sales declined, reflecting the challenges faced by brick-and-mortar retailers in a digital-first world [35]. Similarly, Designer Brands reported a 3.2% decrease in net sales for the third quarter [36]. In contrast, other retailers demonstrated strong performance, with Ulta Beauty’s net sales increasing by an impressive 12.9% and Kroger’s total sales growing by 0.7% in its fiscal third quarter [37]. The discount sector also showed resilience, with Dollar Tree reporting a 4.2% increase in comparable sales after divesting its Family Dollar brand [38].

These divergent outcomes highlight the bifurcation of the retail market, where value, convenience, and a strong omnichannel presence are the key drivers of success. Younger consumers, in particular, are helping to drive growth for brands that can effectively connect with them, despite higher prices resulting from tariffs and inflation [39]. As the sector continues to evolve, the ability to understand and respond to these shifting consumer preferences, while effectively managing supply chain complexities and cost pressures, will be the critical factor separating the winners from the losers.

Professional & Business Services: AI as a Catalyst for Transformation and Growth

The Professional and Business Services sector is undergoing a profound transformation, with Artificial Intelligence emerging as a primary catalyst for both disruption and growth. A recent report from Bain & Company warns that tech services firms risk major revenue loss if they fail to make a strategic shift to embrace AI and automation [40]. This sentiment is echoed across the legal, accounting, and consulting fields, where AI-powered platforms are beginning to execute complex tasks, streamline workflows, and enhance service delivery. In the legal sector, advanced platforms are now managing large workflows with sophisticated agent-based systems, while in accounting, firms are increasingly turning to specialized outsourced services to reduce risk and improve efficiency [41] [42].

The M&A landscape in the financial services sub-sector reflects this transformative trend. After a 20-year low in deal activity earlier in the year, deal volume surged in the second and third quarters of 2025, supported by easing regulatory signals and pent-up demand [43]. While the total value of completed M&A was broadly unchanged in the third quarter, the number of deals reached its lowest level, suggesting a move toward larger, more strategic acquisitions. This rebound in M&A activity is expected to continue, but as a recent report from WTW notes, execution risks are also on the rise, requiring firms to be more diligent and strategic in their integration efforts [43].

This period of intense change is also creating new growth opportunities. According to a new report from Thomson Reuters, tax advisory services are rapidly evolving from a nice-to-have differentiator into a major growth engine for modern accounting firms [44]. This shift is driven by the increasing complexity of the tax code and the growing demand for strategic advice from businesses and high-net-worth individuals. As AI and automation handle more of the routine compliance work, firms are able to focus on higher-value advisory services, creating new revenue streams and deepening client relationships. The firms that can successfully integrate these new technologies and adapt their business models to this new reality will be the ones that thrive in this dynamic and rapidly evolving sector.

Closing Word

The message from this week’s data is unequivocal: the CEO’s chair is hotter, the tenure is shorter, and the demand for agile, transformative leadership has never been greater. The most resilient organizations will be those whose boards treat leadership succession not as a periodic crisis, but as a perpetual strategic imperative.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded to you? Sign up here.