Editor's Note

It’s Monday, a new week, a new slate, and another opportunity to lead with clarity.

CEOs In The News is a weekly intelligence briefing for senior leaders, boards, and those shaping the future of business. Each edition curates the most important executive moves, corporate shifts, and leadership trends — with clear insights on why they matter.

Our mission is simple: deliver clarity, signal, and strategic perspective in minutes — so you start the week one step ahead of the boardroom narrative.

Executive Moves of the Week

The leadership carousel spun with notable velocity this past week, with significant appointments echoing the broader themes of strategic resets and turnaround efforts. In the consumer and beauty sector, Coty Inc. (COTY) announced a major leadership transition, appointing former Procter & Gamble executive Markus Strobel as Executive Chairman and Interim CEO, effective January 1, 2026. Strobel, who brings a 33-year career and a track record of revitalizing prestige brands like SK-II, steps in as CEO Sue Nabi departs after a five-year tenure that saw the successful launch of fragrances like Burberry Goddess and a significant reduction in the company's debt. The move comes as Coty undertakes a strategic review of its Consumer Beauty business, signaling a pivotal moment for the cosmetics giant [1].

Elsewhere, the automotive and powersports industry saw a key change as BRP Inc. (DOO), the maker of Ski-Doo and Sea-Doo, named Denis Le Vot as its new President and CEO on December 16. The technology and cybersecurity sectors also saw movement, with the global cybersecurity certification body ISC2 appointing Scott Beale as its new CEO on December 17. In a clear signal of industry-wide transformation, Hyundai Motor Group announced a slate of year-end executive appointments on December 18, aimed at accelerating its evolution into a software-defined vehicle company. Further highlighting the trend of leadership renewal, the real estate tech firm Opendoor Technologies (OPEN) brought in Lucas Matheson, formerly the CEO of Coinbase Canada, as its new President and named veteran finance executive Christy Schwartz as CFO on December 15. Meanwhile, Cambium Networks addressed a leadership gap by appointing Mitchell Cohen as Interim CFO, effective December 18.

These moves reflect a market where boards are not hesitating to bring in new leadership to navigate strategic inflection points, whether it's a full-scale business model transformation, a strategic review, or a course correction amid market pressures. The emphasis on external hires with specific expertise, as seen with Coty and Opendoor, underscores a growing trend of looking outside the organization for transformational leaders.

Banish bad ads for good

Your site, your ad choices.

Don’t let intrusive ads ruin the experience for the audience you've worked hard to build.

With Google AdSense, you can ensure only the ads you want appear on your site, making it the strongest and most compelling option.

Don’t just take our word for it. DIY Eule, one of Germany’s largest sewing content creators says, “With Google AdSense, I can customize the placement, amount, and layout of ads on my site.”

Google AdSense gives you full control to customize exactly where you want ads—and where you don't. Use the powerful controls to designate ad-free zones, ensuring a positive user experience.

Corporate & Market Shifts

The data reveals a profound shift in the dynamics of CEO succession. A key finding from The Conference Board's latest report is the dramatic acceleration of CEO turnover at S&P 500 companies, with the projected annual rate for 2025 hitting 13%, significantly above the 10% historical average [2]. This surge, which began with a record number of CEO exits in early 2025, is not just a continuation of post-pandemic churn; it represents a new, more proactive stance from corporate boards.

Perhaps the most startling trend is the narrowing gap in turnover rates between high- and low-performing companies. Historically, poor financial results were the primary catalyst for a CEO's departure. However, in 2025, CEOs at companies in the top performance quartile are nearly as likely to be replaced as those in the bottom quartile. This suggests that boards are no longer waiting for a crisis to act. Instead, they are preemptively making changes in response to broader market volatility, intense investor scrutiny, and a rapidly evolving regulatory landscape. The era of CEO immunity, where strong financial performance guaranteed job security, appears to be over.

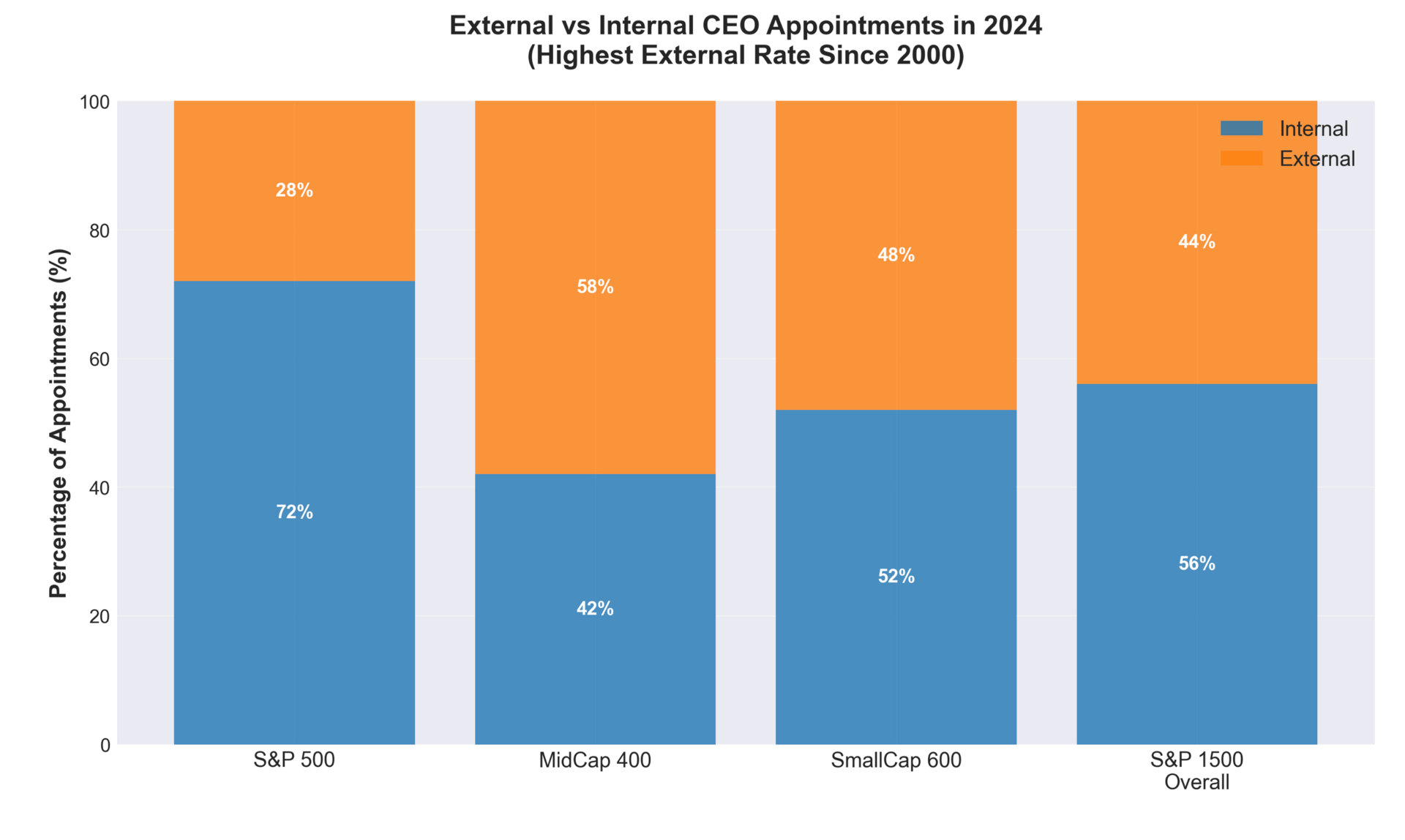

Fueling this trend is a record-breaking pivot towards external candidates. According to a 2024 analysis by Spencer Stuart, 44% of all new S&P 1500 CEO appointments were outsiders, the highest proportion since the firm began tracking the data in 2000 [3]. Mid-cap companies have led this charge, with a striking 58% of new CEOs hired externally. This preference for outsiders, coupled with a rising demand for leaders with prior CEO experience (21% of all incoming CEOs), indicates that boards are prioritizing proven, crisis-tested leadership over the risk of promoting from within.

Figure 1: The narrowing gap between high-performing and low-performing companies in CEO turnover rates demonstrates a fundamental shift in board decision-making.

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

The CEO Lens: The Rise of the First-Time CEO

The increasing reliance on external CEO candidates brings to mind one of the most celebrated corporate turnarounds in history: Lou Gerstner's revival of IBM (IBM). When Gerstner, an executive from RJR Nabisco with no technology background, was appointed CEO in 1993, IBM was on the brink of collapse, having accumulated $15 billion in losses over three years [4]. The move was met with skepticism, yet Gerstner's outsider perspective was precisely what the insular and bureaucratic culture of IBM needed. He famously declared, "the last thing IBM needs right now is a vision," and instead focused on ruthless execution, customer focus, and breaking down internal silos. His success remains the textbook case for the power of an external leader to challenge entrenched orthodoxies and drive radical change.

Conversely, the cautionary tale of General Electric (GE) under Jeff Immelt illustrates the potential pitfalls of a celebrated internal succession. Handpicked by the legendary Jack Welch, Immelt's 16-year tenure was marked by a catastrophic decline in shareholder value and strategic missteps, particularly the failure to swiftly address deep-seated problems within GE Capital [5]. While many factors contributed to GE's fall, the case highlights the risk of an insider being too invested in the status quo and unable to make the tough, objective decisions required to navigate a changing world. The reverence for Welch's legacy may have inadvertently constrained the strategic choices available to his successor.

Today's boards, facing unprecedented disruption, appear to be favoring the Gerstner model. The data shows a clear preference for leaders who have "walked the walk," either as prior public company CEOs or as divisional heads with P&L responsibility. This suggests a belief that in volatile times, the risk of an outsider's learning curve is outweighed by the benefit of their unbiased perspective and proven ability to lead through complexity.

Figure 2: External CEO appointments reached a historic high in 2024, with mid-cap companies leading the trend at 58%.

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

Leadership Insights

Performance is No Longer a Shield: For incumbent CEOs, the message is clear: delivering strong quarterly results is necessary but no longer sufficient for job security. Boards are increasingly forward-looking, assessing a leader's ability to navigate future disruptions, not just manage present challenges. CEOs must proactively build alignment with their boards around a forward-looking strategy and demonstrate the agility to adapt to a rapidly changing external environment.

The Path to CEO is Changing: For aspiring leaders, the rise of the divisional CEO as a primary launchpad to the top job (35% of first-time CEO appointments) is a critical trend [3]. Gaining significant P&L responsibility and demonstrating the ability to run a complex business unit is now the most reliable path to the C-suite, more so than holding a functional role like COO or CFO. Aspiring CEOs should actively seek out these operational roles to build the experience boards are now demanding.

CEOs Who Got It Wrong

The past year has been unforgiving for leaders who failed to deliver. The retail sector, in particular, has been a graveyard for CEOs, with a 116% increase in departures year-over-year [2]. The pain is reflected in the market's judgment of companies undergoing leadership transitions amid deep performance slumps. Six Flags Entertainment (FUN) saw its 1-year Total Shareholder Return (TSR) plummet by a staggering -67.6% leading up to its CEO change. Similarly, The Children's Place (PLCE) appointed a new CEO after its TSR fell by -47.7%. Other companies like Cracker Barrel (CBRL) and Dentsply Sirona (XRAY) also made leadership changes after seeing their shareholder returns fall by over 38%, underscoring the immense pressure on boards to act when value is destroyed on such a scale [6].

Figure 3: Companies with the worst 1-year shareholder returns that underwent CEO transitions in late 2025.

Jobs on the Move

The high rate of turnover has created a fluid market for top executive talent. Several high-profile CEO searches are currently underway, reflecting the demand for transformational leaders across various sectors. Notable open positions include:

MercyOne Trinity Health System: President & CEO

Spectrum for Living: President & CEO

American Society of Transplantation: CEO

Multiple Economic Development Organizations across the U.S.

Coty Inc.: Permanent CEO (following interim period)

Cambium Networks: Permanent CFO

The Watchlist

Succession risk remains a critical concern for investors. Based on recent performance and governance indicators, several companies warrant close attention. Companies with a combination of significant negative shareholder returns, high activist risk profiles, and recent C-suite departures are particularly vulnerable. The retail and consumer sectors, given the high rate of churn, remain a key area to watch. Any company where a long-tenured, iconic CEO is approaching retirement age, in the vein of GE's transition from Welch to Immelt, should also be on every investor's succession watchlist.

Closing Word

The C-suite is experiencing a period of unprecedented change. The old rules of CEO succession are being rewritten as boards become more interventionist, the tenure of leaders shortens, and the demand for proven, external talent grows. This "Great Acceleration" in leadership transitions is not a temporary blip but a fundamental reshaping of corporate governance in an era of perpetual disruption. For leaders and investors alike, understanding these new dynamics is essential for navigating the complex landscape ahead.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded to you? Sign up here.