Editor's Note

It’s Monday, a new week, a new slate, and another opportunity to lead with clarity.

CEOs In The News is a weekly intelligence briefing for senior leaders, boards, and those shaping the future of business. Each edition curates the most important executive moves, corporate shifts, and leadership trends — with clear insights on why they matter.

Our mission is simple: deliver clarity, signal, and strategic perspective in minutes — so you start the week one step ahead of the boardroom narrative.

Executive Moves of the Week

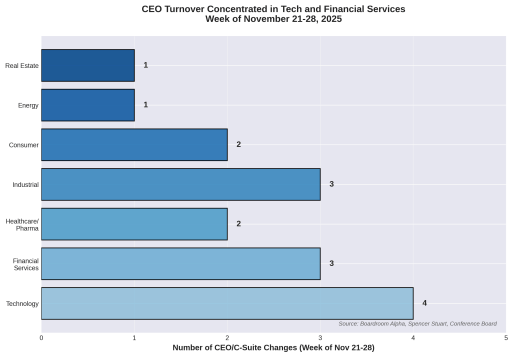

A flurry of C-suite transitions marked the week, with significant moves in the technology, finance, and industrial sectors. Boards appear increasingly willing to make leadership changes to navigate a complex macroeconomic environment and accelerate strategic pivots. The appointments at Xerox and Chart Industries stand out as critical junctures for companies facing intense pressure.

Company | Executive | Role | Status | Significance |

|---|---|---|---|---|

Xerox (XRX) | Chuck Butler | CFO | Appointed | Amid a -70.2 % TSR and high activist vulnerability, Butler's appointment is a critical move to restore financial discipline. |

Chart Industries (GTLS) | Jillian Evanko | CEO & Director | Resigning | Departure of a successful CEO (+20.6 % TSR) with severance amendments suggests a major strategic shift is underway. |

Citigroup (C) | Gonzalo Luchetti | CFO | Appointed | A key financial leadership change at a global banking giant navigating regulatory and market pressures. |

Caption: Analysis of C-suite changes this week shows turnover was most concentrated in the Technology and Financial Services sectors, reflecting ongoing disruption and strategic realignment. Source: Manus AI analysis of public announcements.

Corporate & Market Shifts

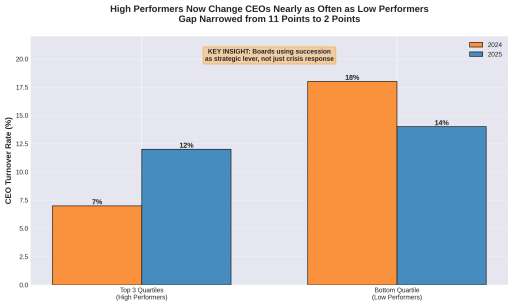

The primary theme this week is the undeniable acceleration of CEO turnover, a trend that has shifted from a reactive measure for poor performance to a proactive strategic tool for boards. New data reveals that high-performing companies are now nearly as likely to replace their CEOs as underperforming ones, marking a fundamental change in governance philosophy.

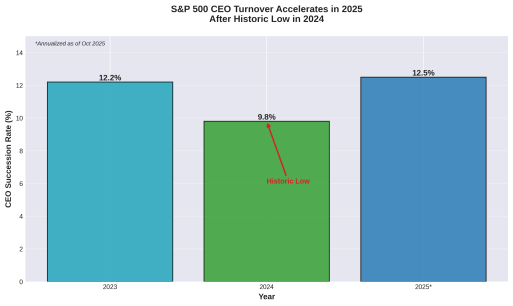

The S&P CEO succession rate climbed to .% in , a significant increase from the historic low of .% in . This rebound is not driven by crisis but by a confluence of factors: the end of planned tenures for leaders who steered their companies through post pandemic volatility, and a growing recognition by boards that the current environment of AI-driven disruption and geopolitical uncertainty is the new normal.

Caption: After a dip in , the CEO succession rate in the S&P has returned to and exceeded levels, indicating boards are no longer delaying leadership transitions. Source: The Conference Board, ESGAUGE.

This trend is mirrored globally. In India, CEO departures at BSE firms in the first half of reached levels last seen during the peak of the COVID- pandemic. Boards are demonstrating a lower tolerance for stagnation and a greater willingness to seek leaders with skills tailored for the future, particularly in navigating AI and automation. This has led to a surge in external hires, who are seen as catalysts for reinvention.

The CEO Lens: The Rise of the First-Time CEO

For decades, CEO succession was a board’s most critical duty, often executed in response to poor performance. The events of signal a paradigm shift: succession is now a forward-looking strategic weapon. The most sophisticated boards are using leadership transitions to prepare their companies for a future that bears little resemblance to the past.

Data from The Conference Board and Egon Zehnder reveals a stunning convergence: CEO turnover at top-quartile performing companies (%) is now nearly identical to that of bottom-quartile performers (%). This is a dramatic narrowing from , when the gap was a full percentage points (% vs. %). The implication is clear: stability is no longer the ultimate prize. In an era of exponential technological change and market volatility, having the right leader for the next five years is more valuable than retaining a successful leader from the last five.

Caption: The gap in CEO turnover between high and low-performing companies has shrunk dramatically, indicating that even successful firms are making leadership changes to adapt. Source: The Conference Board, HBR.

This proactive approach contrasts with historical precedents. The cautionary tale of General Electric under Jack Welch is a case in point. His meticulously planned succession process, once the gold standard, ultimately failed. The chosen successor, Jeff Immelt, proved ill-equipped for the post-/ world and the financial crisis, leading to the dismantling of the industrial giant.

Conversely, IBM in faced an existential crisis with $ billion in cumulative losses. The board hired an outsider, Lou Gerstner, whose crucial decision to keep the company whole and pivot to services proved transformative. He was the right leader for that moment, a profile the internal pipeline could not have produced, enabling a smooth internal succession nine years later after the strategic direction was reset.

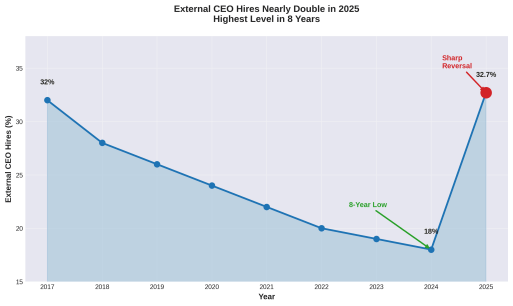

Today’s boards are internalizing these lessons. The near-doubling of external CEO hires in the S&P to .%—the highest in eight years—is a direct admission that the required skills for navigating AI, geopolitical risk, and stakeholder capitalism may not exist internally.

The modern CEO search mandate prioritizes learning agility and the willingness to reinvent the business over deep institutional knowledge. Succession has been reframed from a mark of failure to a declaration of strategic intent.

Leadership Insights

Treat Succession as a Continuous Process, Not a One-Time Event. Boards and CEOs must embed succession planning into their annual strategic reviews. This involves identifying internal successors, mapping external talent, and assessing evolving competency requirements. As recommended by The Conference Board, this process should be linked to enterprise risk management and crisis planning.

Embrace AI as a Core Leadership Competency. Understanding the strategic implications of AI is no longer optional. As noted by James Citrin of Spencer Stuart, AI now features in every global CEO search mandate. Leaders must possess the learning agility to grasp its potential for disruption and reinvention or risk being outmaneuvered.

CEOs Who Got It Wrong

Accountability for performance, or lack thereof, remains a powerful driver of leadership change. This week provided several stark reminders that poor results and personal missteps carry significant consequences.

CarMax (KMX): Longtime CEO Bill Nash was fired amid persistent financial weakness. The move, effective December , is part of a broader leadership shakeup aimed at strengthening the used-car retailer's business. The board's decision underscores that a long tenure is no shield against accountability when financial performance falters.

Verizon (VZ): The ousting of Verizon's CEO earlier this month continues to reverberate as the company proceeds with cutting , jobs. The juxtaposition of mass layoffs with reports that the former CEO could still receive a substantial portion of his $ million salary has drawn sharp criticism.

Campbell's Company (CPB): A Campbell's executive was fired after a leaked recording captured him berating the company's customers. The incident is a textbook case of how a single leader's lack of integrity can inflict immediate and severe brand damage.

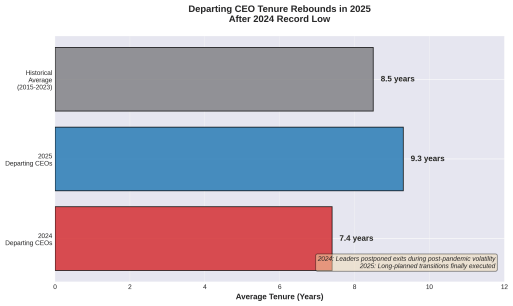

These cases contrast with data showing that the average tenure of departing CEOs is rising, suggesting many recent transitions are planned. However, when performance or ethics falter, boards are demonstrating they will still act decisively.

Caption: While forced exits for performance still occur, the average tenure of departing CEOs rebounded in as leaders who delayed retirement during the pandemic executed their planned transitions. Source: The Conference Board, HBR.

Jobs on the Move

Chart Industries (GTLS): Seeking a new Chief Executive Officer following the announced resignation of Jillian Evanko. The board will be looking for a leader to guide the company through its next strategic phase.

CarMax (KMX): In the market for a new Chief Executive Officer after the termination of Bill Nash. The ideal candidate will need to orchestrate a turnaround for the auto retailer. • Xerox (XRX): While a new CFO has been appointed, the company's significant underperformance (-.% TSR) and activist pressure could signal further C-suite and board changes are on the horizon.

Domino's Pizza: Currently led by an interim CEO, the search for a permanent Chief Executive Officer is a top priority for the board.

The Watchlist

Succession Rumors: Whispers of potential CEO transitions at Walmart and Apple are intensifying, putting a spotlight on two of the world's most influential leadership pipelines. The reports are forcing boards and HR leaders across every industry to re-examine the readiness of their own succession plans.

The Rise of the Outsider: The most critical trend for boards to watch is the dramatic resurgence of the external CEO hire. Boards are now aggressively seeking fresh perspectives, and the rate of external appointments in the S&P nearly doubled in , a clear signal that transformational change is being prioritized over continuity.

Caption: The percentage of external CEO hires in the S&P surged to an eight-year high in , as boards prioritize bringing in outside perspectives to navigate disruption. Source: The Conference Board, HBR.

Rising Leaders: Keep an eye on newly appointed COOs, who are often positioned as the heir apparent. The appointments of Eric Batis at Ashford Inc. and Pratik Trivedi at CTS Corp place them firmly on the CEO watchlist.

Closing Word

The era of the CEO as a steward of continuity is over. The defining leadership mandate of is not to preserve the status quo, but to intelligently disrupt it. Boards are no longer waiting for a crisis; they are proactively changing the architect to design a more resilient and future-proof structure. The message is clear: adapt, reinvent, or be replaced.

CEOs In The News is published weekly for an audience earning $300K to $10MM. It’s intended for educational use to empower executives for the ongoing week. For executive search inquiries, executive branding needs, board advisory services, or newsletter feedback, contact our editorial team. The opinions in this newsletter are not that of its sponsors.

Need Executive Branding? Click here.

Was this email forwarded to you? Sign up here.